Wealthfront Eyes $2 Billion Valuation as Word of Mouth Drives More Than Half of New Sign Ups

Wealthfront’s referrals fuel 50% of new signups 🇺🇸, EQ Bank buys a much bigger grocery store fintech 🇨🇦, crypto bank triple revenue 🇫🇷, Kalshi partners with CNN 🇺🇸 & smart glass payments 🇸🇬

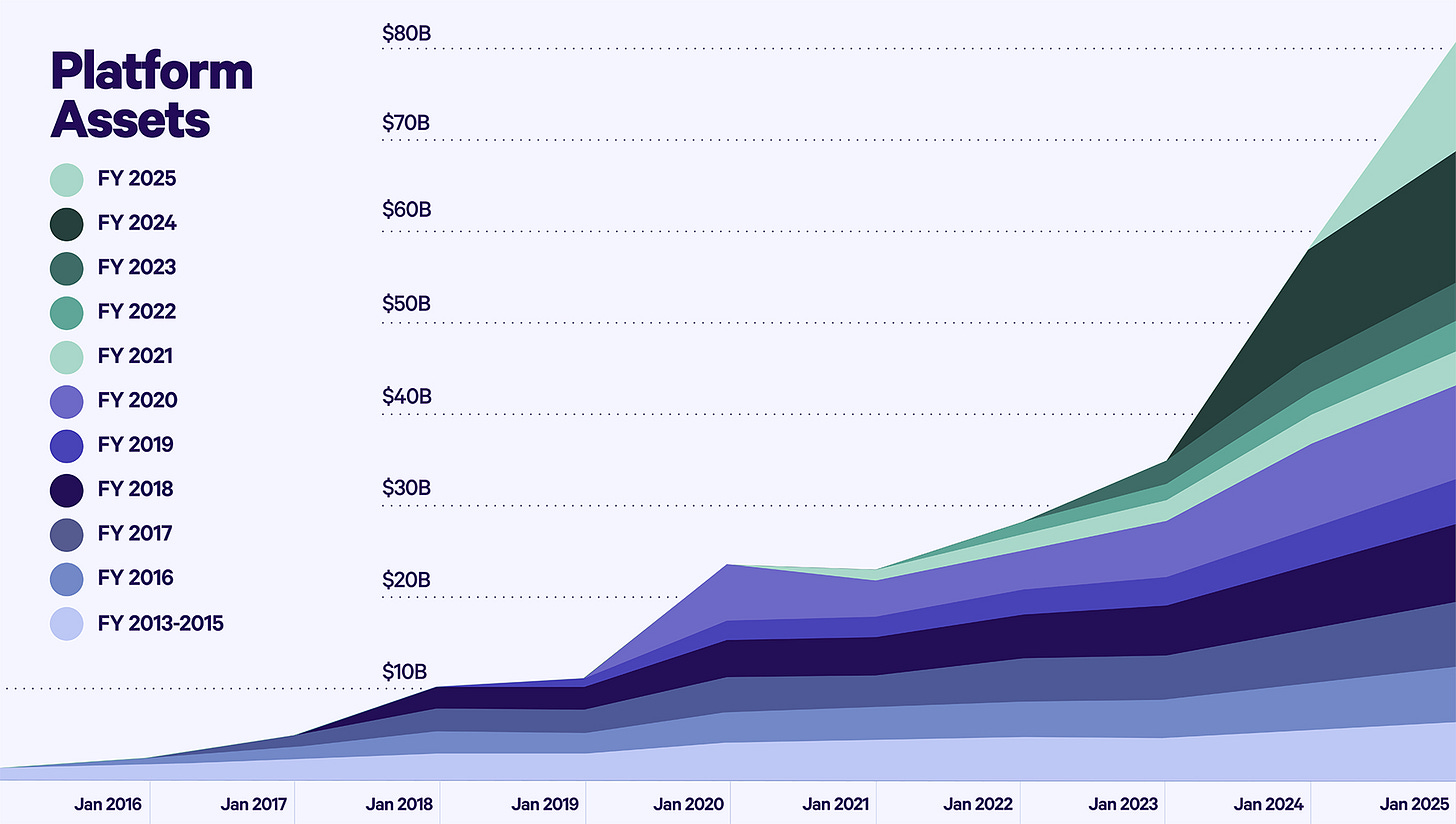

🇺🇸 50% of New Sign-Ups To Wealthfront Come From Referrals

US-based robo-adviser Wealthfront revealed that 40% of its clients made at least one referral between October 2022 and July 2025, according to its latest SEC filing.

The company also disclosed that 19% of its total client base successfully converted at least one new user, a rate that helped grow its funded accounts by 42% in fiscal 2025 to over 1.2 million. Over the past two fiscal years, more than 50% of all new customers came through referrals.

Wealthfront, currently led by CEO David Fortunato (pictured above), attributed its growth to the fairness of its pricing model. In its filing, the company said it does not “charge hidden or unexpected transaction fees” as compared to traditional banks or some wealth management companies. Unlike many fintech platforms that rely on teaser rates or short-term sign-up incentives, Wealthfront also avoids promotional pricing that later reverts to weaker standard rates for its customers.

The disclosure comes as Wealthfront targets a $485 million IPO, offering 34.62 million shares at $12 to $14. At the top end, the listing would value the company at about $2.05 billion. The Palo Alto-based fintech manages $88.2 billion in assets and serves primarily younger digital-native investors through automated investing, high-yield savings and lending products. It reported $60.7 million in net income on $175.6 million in revenue for the six months ended July 31.

Annual net revenue retention has remained above 120% for 11 consecutive years, while client retention has held at around 95% across fiscal 2024 and 2025.

Growth Metric: 19% Successful Client Referral Rate

While 40% of Wealthfront clients attempted a referral, 19% of the total client base successfully converted a new user, creating a “viral loop” that drove over 50% of all new customer acquisition in the last two years

Sources: Bloomberg & Wealthfront SEC filing

🇺🇸 Need a Chief Risk Officer but Can’t Justify the Full-Time Hire? Matthew Komos Has the Solution

SPONSORED - When risk oversight starts stretching your bandwidth, OGMA Risk & Analytics steps in. Founded by Matthew Komos, former VP at TransUnion and 25-year risk management and analytic veteran, OGMA delivers fractional CRO expertise to fintechs and financial institutions.

Their Fractional Chief Risk Officer and Risk Department On Demand programs give immediate access to top-tier risk leadership, analytics, and compliance expertise without the full-time cost. Whether you’re scaling, facing regulatory scrutiny, or building your governance framework, OGMA embeds seamlessly with your team to bring structure, clarity, and control.

Because in a fast-moving market, managing risk shouldn’t slow your growth: it should drive it.

🇨🇦 Canada’s Challenger Banks Buys Loblaw’s Financial Unit for $800M to Scale Past 3 Million Users

EQ Bank, Canada’s top independent challenger bank, is set to acquire PC Financial, the financial services arm of the country’s largest grocery chain, Loblaw.

The $800 million deal that will more than quintuple EQ Bank’s customer base from 607,000 to over 3 million, adding PC Financial’s roughly 2.5 million active customers to its ecosystem. The deal also brings $5.8 billion in assets, over $800 million in retail deposits, and exclusive access to the PC Optimum loyalty program of 17 million members.

EQ Bank’s parent company, Equitable Bank (EQB), reported strong momentum heading into the deal, according to EQB’s 2025 fiscal report. The neobank grew its customer base 18% year-over-year in 2025, adding 21,000 retail and business clients in the fourth quarter of 2025 alone, while deposits climbed 10% to nearly $10 billion.

In recent years, EQ Bank’s growth was fueled by a TV ad campaign involving Schitt’s Creek’s father and son Eugene & Dan Levy, as well as new products such as a notice savings account and a business banking platform.

CEO Chadwick Westlake said the acquisition “made so much more sense” than building credit card capabilities in-house, allowing EQB to fast-track its payments strategy. The merger creates reciprocal benefits: PC Financial users gain access to EQ Bank’s high-interest savings and investment products, while EQ Bank customers, who only had access to a debit Mastercard, enter the credit card market for the first time.

Growth Metric: 18% customer growth in 2025

EQ Bank reached 607,000 customers in 2025, a 18% increase compared to last year and should scale to beyond 3 million with the addition of PC Financial’s 2.5 million customers.

Sources: The Globe and Mail & EQB’s 2025 fiscal report

🇵🇭 Philippines Digital Bank Tonik Doubles Loan Book to $84M, Eyes 2026 Breakeven

Philippines Digital bank Tonik has doubled its loan book over the past year to $84 million, CEO and founder Greg Krasnov (pictured above) announced.

“This round is about scaling with discipline, doubling down on the model which is already working to world-class efficiency levels,” Krasnov wrote in the LinkedIn post.

He also confirmed that the company has recently secured $12 million in a pre-Series C round. Annualized revenue now exceeds $40 million. The bank also recorded a 4.5-fold increase in risk-adjusted margin while maintaining a return on risk-adjusted capital above 25%. Its contribution margin turned positive in late 2024.

Krasnov attributed the growth to Tonik’s credit-inclusion model, which combines low-cost deposits, an AI-driven risk engine, and B2B2C distribution across more than 400 employers and 500 retail partners.

Growth Metric: Loan book doubled to $84 million

Tonik’s lending portfolio doubled year-over-year as the bank pushes toward cash-flow breakeven by first half of 2026.

Sources: Fintech Growth Insider & Fintech News

🇫🇷 French Crypto Bank Deblock Triples Revenue And Raises $35M for Europe Expansion

French crypto banking startup Deblock has tripled its revenue since the start of the year and raised a fresh fundraising round of €30 million (34.9 million USD) to accelerate expansion across Europe, CEO Jean Meyer (pictured above) announced.

The company now serves more than 300,000 customers, with around 100,000 monthly active users. Founded by former neobank Revolut and crypto wallet platform Ledger executives, Deblock combines a traditional current account with a self-custody crypto wallet.

Speaking to Les Echos, Meyer said Deblock is fixing the difficulty of moving money between digital assets and traditional bank accounts. Many banks block transfers from crypto exchanges because they lack proper compliance tools.

The company plans to deploy most of the fresh capital into commercial acquisition and market expansion, with Germany and Austria targeted for launches in early 2026. Deblock aims to hit one million users within six months as it scales beyond France.

Growth Metric: 300% revenue growth in 2025

Deblock has tripled revenue year-to-date, powered by rising demand for its crypto-to-bank bridge across retail users.

Source: Les Echos

🇸🇬 Chinese Payment Giant Targets Smart Glasses to Scale Iris Payments

Iris biometrics remain one of the least used authentication methods globally, according to 2025 recent survey by market research firm Javelin Strategy and Research.

The survey, cited by American Banker, found that 70% of consumers now use some form of biometric authentication, led by fingerprints at 45% and facial recognition at 34%. Iris scanning, by contrast, sits at just 4%.

Ant International is moving in the opposite direction of current consumer habits by building iris authentication directly into Alipay+ GlassPay, its augmented-reality payment system for smart glasses. The Singapore based payments firm, which is the global arm of Chinese payment giant Ant Group, says iris verification could scale much faster once wearable adoption takes off. It points to data from market research from IDC showing that global smart glasses shipments are expected to rise almost sevenfold to 18.7 million units by 2029.

Ant International argues that iris recognition offers a stronger defence against fraud, especially as AI-powered deepfakes proliferate using more than 260 biometric feature points to verify identity.

Growth Metric: 18.7 million projected smart glasses users by 2029

Smart glasses adoption is projected to grow nearly 7X from 2024 levels, creating a new hardware-driven payments surface for iris authentication.

Sources: Fintech Growth Insider & American Banker

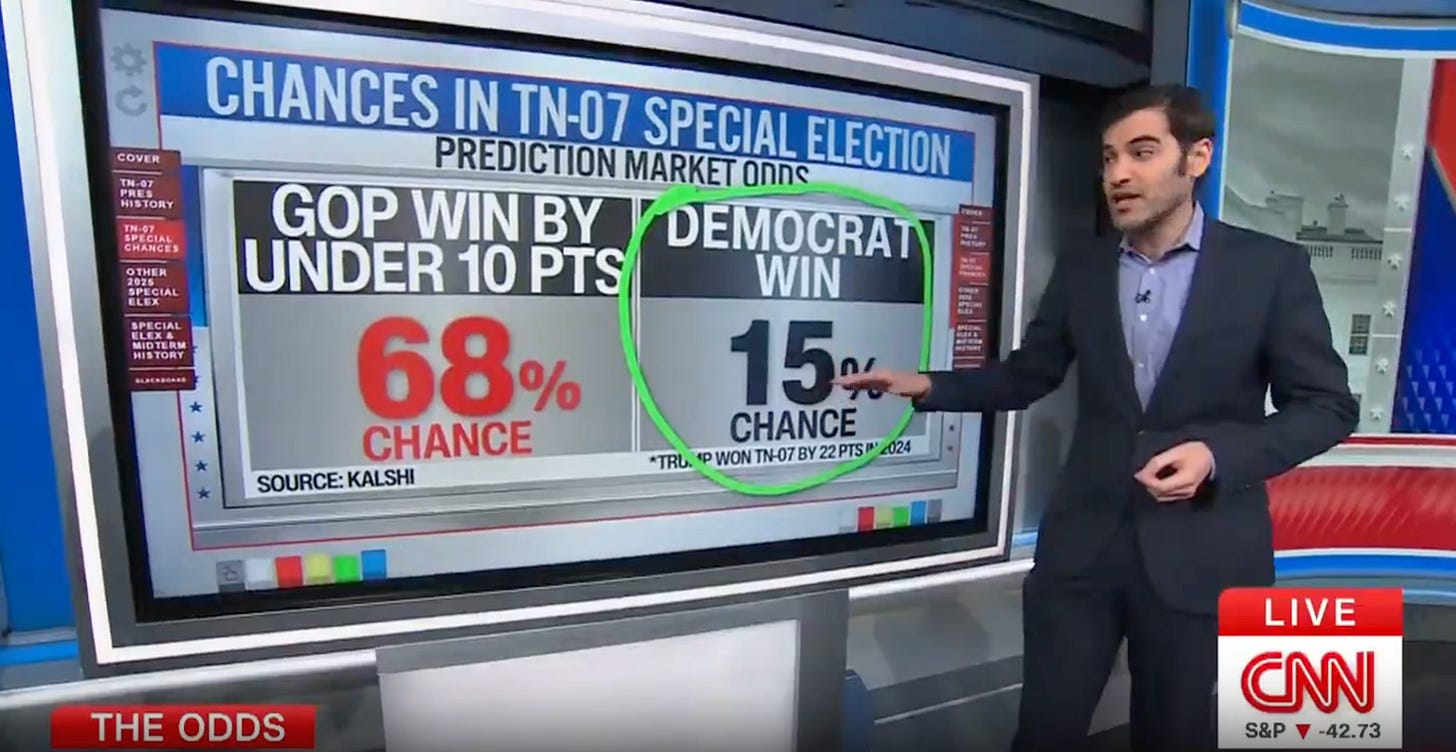

🇺🇸 Kalshi Becomes CNN’s Official Prediction Markets Partner

US based prediction market platform Kalshi has secured a major media distribution deal after announcing a data integration with CNN.

The deal embeds real-time Kalshi probabilities directly into CNN’s live programming, newsroom workflows and on-screen graphics. CNN will also launch a Kalshi-powered real-time ticker for segments that feature prediction data, while newsroom teams gain direct access to Kalshi’s political, cultural and news-based markets for live storytelling and visual analysis.

According to Axios, CNN will not be paying to license Kalshi’s data, but the partnership is exclusive, meaning CNN will not be working with any other prediction market data providers.

In November 2025 alone, Kalshi processed around $5.8 billion in volume, while rival Polymarket hit $3.74 billion, according to data by crypto exchange BingX

While CNN TV audience is dwindling year after year with only 497,000 viewers on average during primetime (8-11pm) in the US, CNN website remains one of the most visited website in the world. Its website attract 126 millions visitors per month globally, according to SemRush, up about 3% compared to 12 month ago.

Growth Metric: 126 millions visitors per month

Kalshi deal with CNN means that CNN.com 126 monthly visitors, as well as its smaller TV audience, will be exposed to Kalshi’s predictions data.

Sources: Fintech Growth Insider & Axios

🇺🇸 Fintech Ad of The Week: Cash App Tells Its Users They Can Change Their Mind After Buying Something & Finance It With Afterpay

US-based mobile financial platform Cash App has launched a new ad campaign on Facebook and Instagram showcasing the native integration of buy now pay later (BNPL) service Afterpay.

The ad shows the seamless connection between the two services, both owned by parent company Block, Inc. Afterpay is presented as a core feature rather than an add-on, allowing Cash App users to split purchases into four installments after making any purchase with Cash App, either online or in-store with its Cash App debit card.

Targeting Gen Z, the campaign also follows a content creator facing costly mishaps such a broken light panel, crashed drone, shattered vase, and headphones stolen by her parrot.

Source: Fintech Growth Insider

Upcoming Fintech Events

🇬🇧 TradingTech Summit London will take place on February 26, 2026, at Hilton Canary Wharf, with tickets priced at £895, with speakers such as Nafisa Yusuf (Director and Head of International Market Structure, BlackRock), Stuart McDowell (UK Chief Information Officer, Societe Generale), and Monika Fernando (Head of Global FI Client Data Analytics and Head of FI eTrading Strategy EAP).

🚨 GFI Exclusive Offer: Enjoy a 15% discount on tickets using the GFI15 promo code

🇺🇸 T3 Technology Conference will take place from March 9 to 12, 2026, in New Orleans, with speakers such as John O’Connell (Founder and CEO, The Oasis Group), Raj Madan (Chief Information Officer, AdvisorEngine), and Oleg Tishkevich (Chief Executive Officer, Invent).

🚨 GFI Exclusive Offer: Save $200 on tickets using the T3GFI200 promo code!

🇬🇧 Insurtech Insights Europe will take place on March 18 to 19, 2026, in London, with tickets priced between £399 and £999. Speakers include Sirma Boshnakova (Board Member), Cécile Paillard (Group Chief Transformation Officer), and Pravina Ladva (Group Chief Digital and Technology Officer).

🚨 GFI Exclusive Offer: Enjoy a 25% discount on tickets using the GFI25 promo code!

Who Am I?

Hi, my name is Julien Brault.

From 2017 to 2024, I was the CEO of Hardbacon, a fintech I co-founded, which reached 400,000 unique visitors at its peak.

A Google update ultimately sealed the company’s fate, and I started this newsletter to keep myself busy in the aftermath.

I then launched an another fintech affiliate site called MooseMoney, but I still find the time to publish this newsletter weekly.

Why share this?

Because my goal is to use my experience as an economic journalist, fintech entrepreneur and product manager to present the most essential fintech news from around the world through the eyes of an insider.

If you like what I do, feel free to share this newsletter and follow me on LinkedIn, X, Reddit, YouTube & TikTok.

If you would like me to accompany you on your fintech entrepreneurship journey and provide you with ongoing feedback, feel free to hire me as coach on MentorCruise.

If all you need is to pick my brain on specific topic in the field of fintech marketing, product or strategy, feel free to book a one hour consulting call with me instead.

P.S : Once you refer a new subscriber to the newsletter using your unique share link, you'll receive a personalized social media shout-out from me to promote your work or professional profile. Just write to me at jrbrault@icloud.com once your referral is confirmed on our leaderboard and include your social media account(s) URL(s) and who you are.

Wealthfront’s rise shows that trust spreads faster than ads. When fair pricing and transparency drive referrals, growth isn’t just about numbers it’s about users believing the system respects them.

Just dropped a new essay here on Substack

The money systems never met you and that's the problem

https://substack.com/@jacobw25/note/p-181704646?utm_source=notes-share-action&utm_medium=web