This $10.8B Credit Card for Rent Payments Now Produces Its Own TV Show 🇺🇸

We're also covering SoFi's 10M-follower influencer hire 🇺🇸, Monzo buying a mortgage broker 🇬🇧, Deel paying $13M/yr for Arsenal's sleeve 🇬🇧 & a lottery savings feature signing 100K users 🇮🇩

Hi Fintechers!

Just wanted to let you know that this issue is the last of the year! I will take a little pause for the holidays. As a result, you can expect to get your next issue of Fintech Growth Insider on January 12.

I’m also working on a podcast I will unveil in January, so feel free to reply to this newsletter with the names of anyone you would like me to interview about fintech growth. I already secured interviews with pretty cool peeps, so nobody is off-limits.

Also, I just started a subreddit about fintech growth! If you want to hear from me before January 12, feel free to join!

🇺🇸 Bilt, The Credit Card for Rent Payments, Launched a Friends-like Sitcom With 500K Views Per Episode

Bilt, the fintech that allows Americans to pay their rent with a credit card, launched Roomies, a Friends-like sitcom optimized for phone consumptions. Since the series’ launch in June, it has amassed 15 million cumulative views. New episodes can reach up to 500,000 views across TikTok Instagram and YouTube Shorts, according to the Los Angeles Times.

The first season of the short form series runs about 50 minutes across 22 episodes. Instead of pushing product messages, the show follows a young woman who moves from Ohio to New York and shares an apartment with three other roommates, focusing on their working lives, relationships, and the everyday realities of surviving in the city. Bilt appears only in the background, through moments such as dining ou or paying a bill using the Bilt app. The second season is scheduled to debut in January 2026.

“The objective is to build brand awareness and positive sentiment at scale,” Cyrus Ferguson (pictured above), Bilt’s senior content director and co-creator of Roomies, told the Los Angeles Times. He said owning a scripted universe gives the company more control and longevity than creator-led strategies. The company was last valued at $10.8 billion after raising $250 million in fresh funding in July 2025.

Growth Metric: 15 million cumulative views

Bilt’s original series Roomies has surpassed 15 million views across TikTok, YouTube Shorts and Instagram, with single episodes reaching up to 500,000 views, according to the company.

Sources: Fintech Growth Insider & LA Times

🇺🇸 Need a Chief Risk Officer but Can’t Justify the Full-Time Hire? Matthew Komos Has the Solution

SPONSORED - When risk oversight starts stretching your bandwidth, OGMA Risk & Analytics steps in. Founded by Matthew Komos, former VP at TransUnion and 25-year risk management and analytic veteran, OGMA delivers fractional CRO expertise to fintechs and financial institutions.

Their Fractional Chief Risk Officer and Risk Department On Demand programs give immediate access to top-tier risk leadership, analytics, and compliance expertise without the full-time cost. Whether you’re scaling, facing regulatory scrutiny, or building your governance framework, OGMA embeds seamlessly with your team to bring structure, clarity, and control.

Because in a fast-moving market, managing risk shouldn’t slow your growth: it should drive it.

🇬🇧 Payroll Platform Deel to Pay $13.4M/Year To Sponsor English Football Club Arsenal

US-based payroll and HR platform Deel has secured a minor sponsorship with English football club Arsenal for £10 million ($13.4 million) annually, starting in the 2026-27 season.

The sponsor slot is on the team’s shirt sleeve and will replace Visit Rwanda, ending an eight-year partnership after Arsenal fans raised concerns about human rights violations by Rwanda’s government. Arsenal is currently ranked number one in the English Premier League with a valuation of $3.4 billion.

In a previous interview on the 20VC Podcast, Deel chief executive Alex Bouaziz explained that performance-based online advertising works when a company is small, but becomes less effective at scale. To grow from what he described as “between 10 million and 100 million” users, he believes brand recognition is far more important.

He argues that if Deel becomes a familiar name through partnerships with major sports teams, customers will come to the company naturally. “The bigger your brand, the less you need to pay per lead,” Bouaziz said in the podcast.

Bouaziz previously told the Financial Times that Deel has been profitable for three years. Its revenue passed $100 million in September, and it now generates between $15 million and $17 million a month in earnings before key costs, while still growing at about 70%.

Growth Metric: 70% Growth Rate

Deel combines fast scaling with strict discipline, achieving a 70% growth rate while maintaining profitability over the last three years

Sources: Fintech Growth Insider, Financial Times and The Athletic

🇺🇸 SoFi Gives "Your Rich BFF" Influencer Vivian Tu a C-Suite Title

Digital finance platform SoFi has formalised its partnership with financial influencer Vivian Tu, better known as “Your Rich BFF,” by appointing her as Chief of Financial Empowerment.

This is a C-suite title, which the company describes as honorary. The role builds on a two-year collaboration in which Tu hosted four seasons of SoFi’s YouTube series Richer Lives, interviewing public figures such as skateboard legend Tony Hawk and American actress Yara Shahidi about navigating major financial decisions.

Under the new arrangement, Tu will continue working with SoFi on financial literacy content and lead a Generational Wealth Fund initiative scheduled to launch in 2026.

In an interview with Bloomberg Television, Tu said the initiative mirrors SoFi’s previous cause-based partnerships with NBA player Jayson Tatum and American country singer Kelsea Ballerini, focusing on supporting communities and financial literacy for Gen Zs and millennials.

SoFi now serves more than 12.6 million members across borrowing, saving, spending and investing. In its latest quarter, SoFi reported record loan originations of $9.9 billion, up 57% year on year, as of September 2025, driven by strong growth in personal, student and home lending.

Growth Metric: 10 million creator-owned followers

SoFi’s new Chief of Financial Empowerment, Vivian Tu, better known as “Your Rich BFF”, have about 10 million followers across TikTok, Instagram, YouTube, Facebook and Snapchat.

Source: Fintech Growth Insider

🇬🇧 UK Digital Bank Monzo Acquires Habito to Start Selling Morgages In-App

UK digital bank Monzo has agreed to acquire mortgage broker Habito in order to allow its customers to secure a mortgage directly inside the Monzo app.

Monzo points to 2024 research showing that 87% of UK homebuyers used a mortgage broker, showcasing how important brokers remain to the buying journey of British house hunters. By folding Habito into its app, Monzo aims to simplify what its chief banking officer Kunal Malani described as a complex and stressful process.

The integration will build on Monzo’s existing Home Ownership feature, where more than 450,000 customers already track their property values and mortgage balances.

The bank reported revenue growth of 48% year on year to £1.2 billion in 2025, supported by a user base of 14 million consumers and about 800,000 businesses.

Growth Metric: 87% mortgage broker usage

Nearly nine in ten UK homebuyers use a mortgage broker, giving Monzo a clear reason to bring Habito directly into its app.

Sources: Financial Times & FinTech Magazine

🇬🇧 Revolut and Audi Lift the Curtain on New Formula One Team

The Audi Revolut F1 Team has officially revealed its new name and logo. Revolut Global CMO Antoine Le Nel confirmed in a LinkedIn post that the full car design and launch will take place in Berlin on January 20, 2026.

This announcement finalizes the major partnership signed in July 2025 between the German car giant and the UK-based digital bank. The team will use Revolut Business to handle its daily finances and make international payments as it prepares to join the grid for the 2026 FIA Formula One World Championship.

As previously reported by Fintech Growth Insider, companies like Revolut, Airwallex, and OKX spent over $500 million on Formula 1 sponsorships in 2025 alone. The average F1 deal now costs more than $6 million, nearly double what it was in 2019, as companies pay for global attention.

Growth Metric: $500 million investment into F1 in 2025

Fintech companies collectively invested over $500 million into F1 for the 2025 season alone, using the sport’s global reach to find new users and build brand fame.

Source: Fintech Growth Insider

🇮🇩 Lottery Style Savings Feature Drives Breakout Growth for Indonesian Digital Bank Superbank

A new gamified savings product helped Indonesian digital bank Superbank sign up 100,000 users in just two weeks. The feature, called “Kartu Untung” (Lucky Card), was developed with direct help from Korea’s largest internet bank, KakaoBank.

KakaoBank is a subsidiary of KakaoCorp, which runs South Korea’s dominant messenger app KakaoTalk, with over 48 million users in said country alone. KakaoBank, which bought a 10% stake in Superbank in 2023, designed the product to turn saving money into a game.

Superbank, which currently have 5 million customers, runs a daily, lottery-style cashback draw for small deposits of 50,000 rupiah ($3 USD). This strategy allows the Indonesian bank to grow its customer base, while also increasing its total deposits.

Superbank, which currently has led by President Director Tigor M Siahaan (pictured above), is set to list on the Indonesia Stock Exchange later this month, having reported a quarterly profit just nine months after launching.

Superbank’s growth relies heavily on using its partners to find customers. Nearly 60% of its users came directly from the South East Asia’s superapp Grab and Indonesia-based digital wallet OVO. KakaoBank now plans to use this same strategy in Thailand, where it recently received approval to launch a new virtual bank.

Growth Metric: 100,000 users in two weeks

By turning savings into a game with lottery rewards, Superbank signed up 100,000 new users in just 14 days.

Source: The Korea Times

🇺🇸 Imprint Reaches Unicorn Status With AI-Powered Co-Branded Credit Cards

Co-branded credit card startup Imprint Payments, that just raised 150 millions at a $1.2 billion valuation, grew almost 300% last year, according to CEO Daragh Murphy (pictured above).

Despite not being known by the public, the company managed to grow to such a scale by signing giant retailers such as Brooks Brothers, Crate & Barrel, and Booking.com. Imprint issued credit cards for those giant retailers, and those marketed it to their large customer base. Unlike traditional credit card issuing partnerships, however, Imprint embeds the financial experience directly into the retailer’s app.

CEO Daragh Murphy told Bloomberg that, while the business grew “almost 300% in the last year,” their headcount grew by less than 20%. He emphasized that the company can “buy or build an AI solution for many things” to avoid hiring waves.

In a LinkedIn post, Imprint said partners see eight times higher lifetime value and a 20% increase in customer spend after switching from legacy credit cards issuers.

Growth Metric: 300% growth in 12 month

By embedding its credit cards withing its retail partners’s portals and apps, Imprint achieved 300% business growth in the last year.

Sources: Fintech Growth Insider & Bloomberg

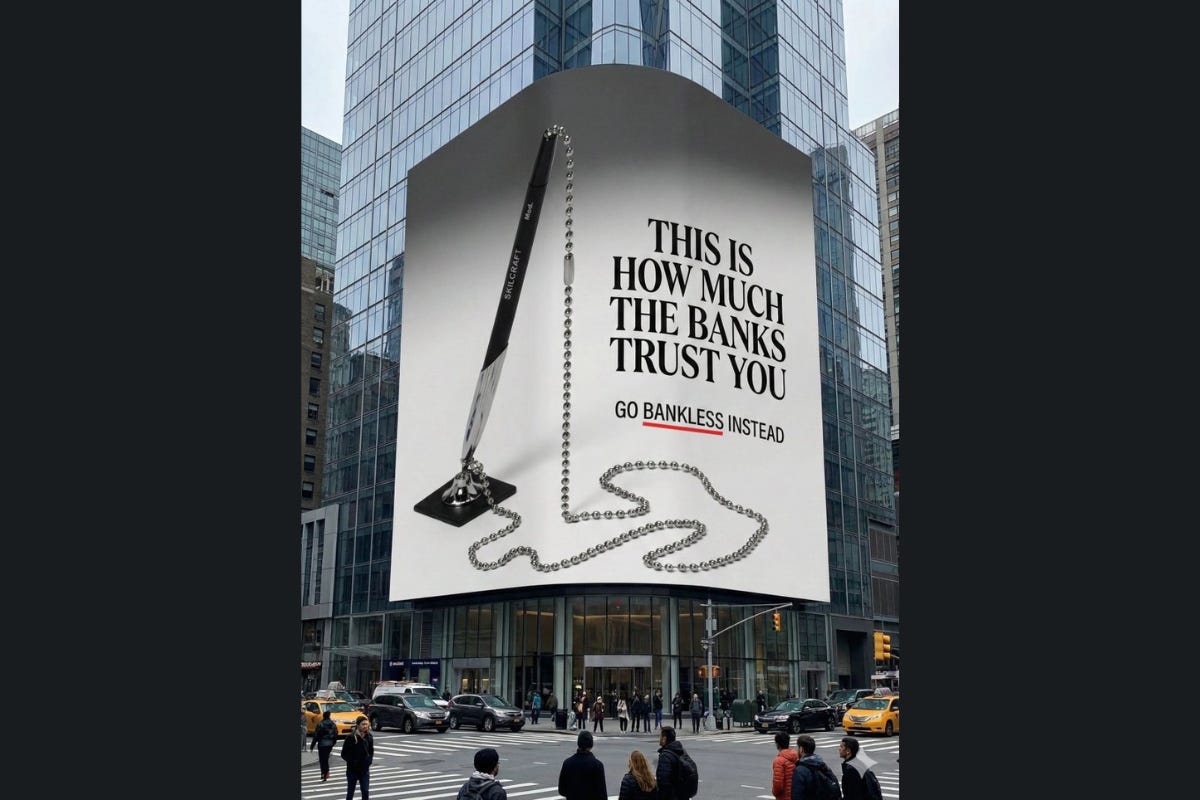

🇺🇸 Fintech Ad of The Week: Bankless Mocks Traditional Banks With an AI Generated Chained Pen Billboard

Crypto media platform Bankless has posted an AI image of a billboard featuring a cheap pen chained to a bank counter.

The image, which was shared by Bankless on their official X account, reached 1.9 million views on X... without having to actually pay for a billboard. Bankless uses this to make a point of how traditional banks treat customers like potential thieves over a plastic pen.

The post positions crypto as a way to break free from a system built on suspicion rather than trust, urging people to go “Bankless” instead. The chained pen imagery is nothing new and has been used by other banks in the past. That said, given the number of views it got for free on X, it’s an interesting fintech marketing AI use case.

Source: Fintech Growth Insider

Upcoming Fintech Events

🇭🇰 Consensus Hong Kong will take place from February 18 to 20, 2026, at Hong Kong Convention and Exhibition Centre, with tickets priced between $399 and $799, with speakers such as Jordan Gray (CoFounder and CMO, PublicAI), Joelly Gloria (Business AI @ Meta), and Ming Wu (Co-founder/CTO, 0G)

🇬🇧 TradingTech Summit London will take place on February 26, 2026, at Hilton Canary Wharf, with tickets priced at £895, with speakers such as Nafisa Yusuf (Director and Head of International Market Structure, BlackRock), Stuart McDowell (UK Chief Information Officer, Societe Generale), and Monika Fernando (Head of Global FI Client Data Analytics and Head of FI eTrading Strategy EAP).

🚨 GFI Exclusive Offer: Enjoy a 15% discount on tickets using the GFI15 promo code

🇺🇸 ICBA LIVE will take place from March 6 to 9, 2026, in San Diego, with speakers such as Rebeca Romero Rainey (President and CEO, Independent Community Bankers of America), Jack E. Hopkins (ICBA Chairman and President and CEO, CorTrust Bank), and Alice P. Frazier (ICBA Chairman elect and President and CEO, Potomac Bank).

🇺🇸 T3 Technology Conference will take place from March 9 to 12, 2026, in New Orleans, with speakers such as John O’Connell (Founder and CEO, The Oasis Group), Raj Madan (Chief Information Officer, AdvisorEngine), and Oleg Tishkevich (Chief Executive Officer, Invent).

🚨 GFI Exclusive Offer: Save $200 on tickets using the T3GFI200 promo code!

🇬🇧 CBC Summit Europe will take place on March 17, 2026, in London, with tickets priced between £906.43 and £1,246.53, with speakers such as Jason Allegrante (Chief Legal and Compliance Officer, Fireblocks), Ajay Amlani (President and CEO, Aware, Inc.), and Sabih Behzad (Head of Digital Assets and Currencies Transformation, Deutsche Bank).

🇬🇧 Insurtech Insights Europe will take place on March 18 to 19, 2026, in London, with tickets priced between £399 and £999. Speakers include Sirma Boshnakova (Board Member), Cécile Paillard (Group Chief Transformation Officer), and Pravina Ladva (Group Chief Digital and Technology Officer).

🚨 GFI Exclusive Offer: Enjoy a 25% discount on tickets using the GFI25 promo code!

Who Am I?

Hi, my name is Julien Brault.

From 2017 to 2024, I was the CEO of Hardbacon, a fintech I co-founded, which reached 400,000 unique visitors at its peak.

A Google update ultimately sealed the company’s fate, and I started this newsletter to keep myself busy in the aftermath.

I then launched an another fintech affiliate site called MooseMoney, but I still find the time to publish this newsletter.

Why share this?

Because my goal is to use my experience as an economic journalist, fintech entrepreneur and product manager to present the most essential fintech news from around the world through the eyes of an insider.

If you like what I do, feel free to share this newsletter and follow me on LinkedIn, X, Reddit, YouTube & TikTok.

If you would like me to accompany you on your fintech entrepreneurship journey and provide you with ongoing feedback, feel free to hire me as coach on MentorCruise.

If all you need is to pick my brain on specific topic in the field of fintech marketing, product or strategy, feel free to book a one hour consulting call with me instead.

P.S : Once you refer a new subscriber to the newsletter using your unique share link, you'll receive a personalized social media shout-out from me to promote your work or professional profile. Just write to me at jrbrault@icloud.com once your referral is confirmed on our leaderboard and include your social media account(s) URL(s) and who you are.