Ramp Courts Brex Customers Amid Capital One Takeover 🇺🇸

We're also covering Chocolate Finance bringing lifestyle-led savings to Hong Kong 🇭🇰, Affirm moves into rent loans 🇺🇸, NYSE's 24/7 trading plan 🇺🇸 & Kuda expanding to Canada & Tanzania 🇹🇿 🇨🇦

Hi Fintech Maniacs,

You probably already saw it, since I sent it to you already, but Fintech Growth Insider now officially have a podcast!

If it’s not already done, please add it to your favourite podcast app like Apple Podcast, Spotify or Overcast to make sure you don’t miss any episode.

I also launched a Reddit sub where you are free to ask any fintech growth question you may have or share cool fintech campaigns.

Yup, the Fintech Growth Insider “empire” is growing :)

Julien Brault

🇺🇸 Ramp Courts Brex Customers Amid Capital One Takeover

Ramp is moving to capture customers from competitor Brex ahead of Capital One’s planned US$5.15 billion acquisition.

Capital One’s acquisition of Brex, expected to close in mid-2026, values the company well below its US$12.3 billion peak. Meanwhile, Ramp, led by CEO Eric Glyman (pictured above), remains independent with a valuation of about US$32 billion, up from $75 million in 2020.

Ramp executives said the deal creates an opening for Ramp, with director of engineering Leo Mehr saying In a LinkedIn post that bank integration can slow product development, calling the acquisition a “generational opportunity” for Ramp.

In a blog post, Ramp urged finance teams using Brex to watch for possible changes to its product roadmap, customer support, and pricing or policies as the platform moves under bank ownership, and to pay close attention to any customer updates on opt-in requirements or account transitions.

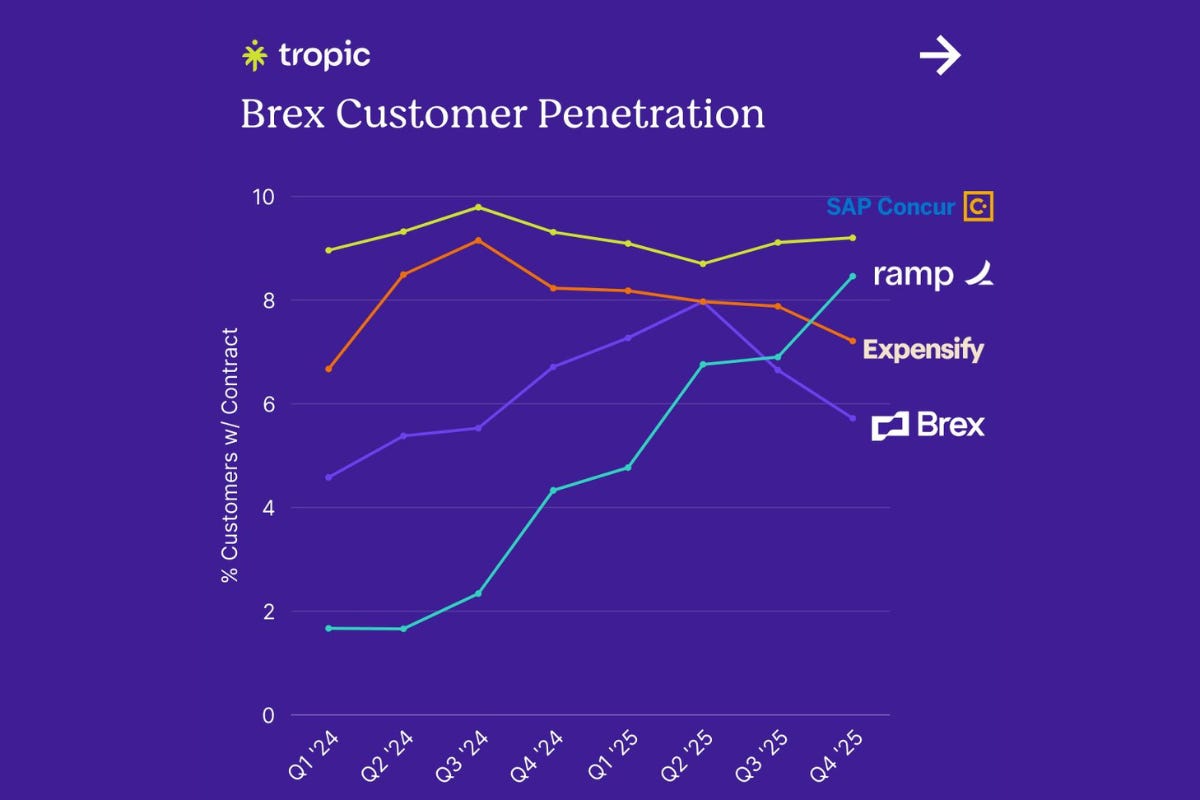

Analysis by spend management firm Tropic suggests Brex’s Empower platform was launched too early, driving customer churn in 2025 as users switched to Ramp. In a LinkedIn post, Tropic co-founder and COO Justin Etkin said signs of decline were visible as early as the second quarter of 2023, citing product issues and “promises that didn’t meet reality”

Ramp is generating more than $1 billion in annualised revenue as of November 2025 data and is free cash flow positive. It serves over 50,000 customers and enables more than $100 billion in annualised purchase volume. Brex, by comparison, recorded about $700 million in revenue in 2025.

Growth metric: From $75 million to $32 billion valuation

Ramp is valued six times higher ($32 billion versus to Brex’s $5.15 billion exit), and processed more than $100 billion in annualised purchase volume.

Source: Fintech Growth Insider

🇺🇸 Is Your Risk Function Ready For Growth?

SPONSORED - Take the Risk Pulse Check quiz and find out in 60 seconds.

10 questions. Instant results. Zero cost.

Based on 200+ risk engagements with lenders worldwide.

🇭🇰 Crazy Rich Asians-Inspired Neobank Chocolate Finance Plants Flag in Hong Kong

Chocolate Finance, a wealth management platform, has officially expanded from its home base of Singapore to Hong Kong.

The move is a calculated bet on one of Asia’s most cash-rich and yield-hungry demographics. According to the HSBC Affluent Survey released in January 2026, the perceived threshold for “middle class” status in Hong Kong has climbed to HK$8.35 million in liquid assets, roughly US$1.08 million.

About 1 in 13 Hong Kongers now qualifies as a millionaire, and many reach the HK$10 million (1.3 million USD) mark by age 39, typically within eight years of crossing their first million.

The survey also found that over half of its respondents held at least HK$1 million (128,000 USD) in liquid assets. Nearly 70% built their wealth through investments, business profits, interest earnings and rental income.

On the ground, Chocolate Finance has brought in Shawn Lam as its Hong Kong Head of Social Growth and Partnership. Lam previously served as brand director at Hong Kong homegrown pizza chain Dough Bros and will report to Tim Jones (pictured above), Chocolate Finance’s Hong Kong CEO.

To stand out, Chocolate Finance is leaning hard into lifestyle branding and signed Crazy Rich Asians actor Henry Golding (pictured above) as its ambassador, targeting the aspirational class that wants their money working toward a “richer life.”

Growth Metric: 1 in 13 Hong Kongers are millionaires

Over half of residents surveyed hold at least HK$1 million in liquid assets, with many reaching HK$10 million by age 39.

Sources: Fintech Growth Insider, Fintech News & Marketing Interactive

🇺🇸 Affirm Now Lets Renters Split Payments Through New Partnership

Buy now, pay later provider Affirm has partnered with rent reporting platform Esusu to allow some renters to pay their rent in two instalments.

For Affirm, led by CEO Max Levchin (pictured above), the partnership extends its BNPL model beyond retail into recurring, essential payments such as rent, an area where credit cards have traditionally had limited reach. Affirm currently has 24.1 million active consumers.

Under the pilot programme, eligible renters using Esusu can split their monthly rent into two payments at 0% interest, with no late fees. Affirm provides the financing, while Esusu continues to handle rent collection and report on time payments to credit bureaus as part of its credit-building service.

Esusu processes about US$100 billion in annual gross lease volume and serves roughly 12 million renters across five million homes, working with property owners and renters rather than managing units directly.

Growth metric: 12 million Esusu renters able to use Affirm’s BNPL

Affirm can now offer its BNPL service to 12 million renters who use Esusu’s platform for rent payments.

Sources: Fintech Growth Insider, CNBC & PYMNTS

🇺🇸 NYSE Eyes Round-The-Clock Trading With Tokenised Shares

The New York Stock Exchange (NYSE) is seeking regulatory approval to allow shares listed on its exchange to trade around the clock through blockchain-based tokens that represent company stock.

The NYSE currently operates from 9:30am to 4:00pm Eastern Time on weekdays. Transactions under the proposed model would settle instantly on-chain, potentially replacing the current one-day clearing cycle.

As of January 2025, extended-hours activity accounted for more than 11% of all US equity trading, with over 1.7 billion shares traded daily, up from just over 5% in the first quarter of 2019. By value, extended-hours trading averaged more than US$61 billion a day in 2024, accounting for nearly 10% of total dollar volume in the fourth quarter.

The exchange processes an average of about 1.6 billion shares a day during its regular trading hours.

Smaller venues have begun experimenting with tokenised equities, including BitMEX, which launched tokenised equity perpetual in January 2026 tied to shares such as Apple, Tesla and Nvidia.

Growth metric: 1.7 billion shares traded daily

More than 1.7 billion shares are traded daily during extended US equity trading hours.

Sources: Fintech Growth Insider & Wall Street Journal

🇳🇬 Nigerian Challenger Bank Expands Into Canada And Tanzania

Nigerian neobank Kuda Bank processed $20.4 billion (₦29 trillion) across more than one billion transactions in 2025 and is moving into Canada and Tanzania to capture cross border remittances.

In Canada, Kuda is targeting more than 100,000 Nigerians who still rely on third-party services to send money home. In Tanzania, the bank has secured a payment service provider licence, allowing it to distribute funds more cheaply across East Africa. Headquartered in the UK, Kuda is leaning on its flat fee pricing to disrupt remittances, for example, charging £3 (about $4.07) per transfer in its UK corridor, regardless of the amount sent, up to £10,000, undercutting legacy providers that can charge up to an average of 8%.

Kuda, led by Babs Ogundeyi cut losses by 84% in 2024 to US$5.8 million after pulling back from aggressive user growth, and now projects 1.7 million monthly active users by December 2026, though it has not disclosed current active user figures after reporting more than seven million registered customers in 2024.

Growth metric: $20.4 billion in transaction value

Kuda Bank has processed over 1 billion transactions in 2025 alone, amounting to $20.4 billion in transaction value

Sources: Fintech Growth Insider, Technext & Business Day

🇬🇧 Fintech Ad of The Week: All-in-one Investment and Crypto Tracker Delta Makes Sense of Messy Portfolios

All-in-one investment and crypto tracker Delta by eToro leans into a familiar frustration for retail investors of having their money scattered across multiple platforms with no clear view of their overall performance.

For a generation that often uses multiple trading apps, Delta provides a real-time view of their money in one dashboard.

The portfolio tracker, built in Belgium and acquired by Israeli-based brokerage platform eToro in 2019, connects to more than 5,000 financial institutions and wallets.

Source: Fintech Growth Insider

Upcoming Fintech Events

🇨🇳 Consensus Hong Kong will take place from February 18 to 20, 2026, at Hong Kong Convention and Exhibition Centre, with tickets priced between $399 and $799, with speakers such as Jordan Gray (CoFounder and CMO, PublicAI), Joelly Gloria (Business AI @ Meta), and Ming Wu (Co-founder/CTO, 0G)

🇬🇧 TradingTech Summit London will take place on February 26, 2026, at Hilton Canary Wharf, with tickets priced at £895, with speakers such as Nafisa Yusuf (Director and Head of International Market Structure, BlackRock), Stuart McDowell (UK Chief Information Officer, Societe Generale), and Monika Fernando (Head of Global FI Client Data Analytics and Head of FI eTrading Strategy EAP).

🚨 GFI Exclusive Offer: Enjoy a 15% discount on tickets using the GFI15 promo code

🇺🇸 ICBA LIVE will take place from March 6 to 9, 2026, in San Diego, with speakers such as Rebeca Romero Rainey (President and CEO, Independent Community Bankers of America), Jack E. Hopkins (ICBA Chairman and President and CEO, CorTrust Bank), and Alice P. Frazier (ICBA Chairman elect and President and CEO, Potomac Bank).

🇺🇸 T3 Technology Conference will take place from March 9 to 12, 2026, in New Orleans, with speakers such as John O’Connell (Founder and CEO, The Oasis Group), Raj Madan (Chief Information Officer, AdvisorEngine), and Oleg Tishkevich (Chief Executive Officer, Invent).

🚨 GFI Exclusive Offer: Save $200 on tickets using the T3GFI200 promo code!

🇬🇧 CBC Summit Europe will take place on March 17, 2026, in London, with tickets priced between £906.43 and £1,246.53, with speakers such as Jason Allegrante (Chief Legal and Compliance Officer, Fireblocks), Ajay Amlani (President and CEO, Aware, Inc.), and Sabih Behzad (Head of Digital Assets and Currencies Transformation, Deutsche Bank).

🇬🇧 Insurtech Insights Europe will take place on March 18 to 19, 2026, in London, with tickets priced between £399 and £999. Speakers include Sirma Boshnakova (Board Member), Cécile Paillard (Group Chief Transformation Officer), and Pravina Ladva (Group Chief Digital and Technology Officer).

🚨 GFI Exclusive Offer: Enjoy a 25% discount on tickets using the GFI25 promo code!

🇺🇸 Fintech Americas will take place from March 24 to 26, 2026, in Miami, with tickets priced between $795 and $2,195, with speakers such as Cristina Junqueira (Co Founder and Chief Growth Officer, Nubank), Biswa Sengupta (Managing Director for Generative AI, JPMorgan Chase), and Rohit Patel (Director, Meta Superintelligence Labs, Meta).

🚨 GFI Exclusive Offer: Enjoy a 10 percent discount on tickets using the GFI10 promo code.

🇬🇧 PAY360 will take place from March 25 to 26, 2026, in London, with speakers such as Will Marwick (Chief Executive Officer, IFX Payments), Jas Narang (Chief Transformation and AI Officer, Santander), and Saira Khan (Head of Innovation and Partnerships, First Direct Bank).

🇺🇸 InsurTech NY Spring will take place from March 30 to 31, 2026, in New York City, with tickets priced between $657 and $1,017, with speakers such as Raj Kalahasthi (Chief Information Officer, The Baldwin Group), Patrick Gallic (Head of International AI Hub, Tokio Marine), and Greg Hendrick (Chief Executive Officer, Vantage Risk).

Who Am I?

Hi, my name is Julien Brault.

From 2017 to 2024, I was the CEO of Hardbacon, a fintech I co-founded, which reached 400,000 unique visitors at its peak.

A Google update ultimately sealed the company’s fate, and I started this newsletter to keep myself busy in the aftermath.

I then launched an another fintech affiliate site called MooseMoney, but I still find the time to publish this newsletter.

Why share this?

Because my goal is to use my experience as an economic journalist, fintech entrepreneur and product manager to present the most essential fintech news from around the world through the eyes of an insider.

If you like what I do, feel free to share this newsletter and follow me on LinkedIn, X, Reddit, YouTube & TikTok.

If you would like me to accompany you on your fintech entrepreneurship journey and provide you with ongoing feedback, feel free to hire me as coach on MentorCruise.

If all you need is to pick my brain on specific topic in the field of fintech marketing, product or strategy, feel free to book a one hour consulting call with me instead.

P.S : Once you refer a new subscriber to the newsletter using your unique share link, you'll receive a personalized social media shout-out from me to promote your work or professional profile. Just write to me at jrbrault@icloud.com once your referral is confirmed on our leaderboard and include your social media account(s) URL(s) and who you are.

Great roundup on the Ramp/Brex situation. The timing insight from Tropic about Empower launching too early is telling, product-market fit can't be rushed evenwhen you're trying to stay ahead. I've seen similar patterns in other verticals where early movers lose to fast followers who nail execution. The $100B purchase volume Ramp is processing now realy shows how much corprate spend moved to software.