Revolut Eyes Turkish Banking License Through FUPS Acquisition as Inflation Drives Foreign Currency Demand 🇹🇷

We're also covering PicPay's lending-fueled 79% profit jump 🇧🇷, a robo-advisor growing 600% in Hong Kong 🇨🇳, PayPal's 20% sales lift tool 🇺🇸 & JPMorgan buying the Apple card on the cheap 🇺🇸

Hi Guys!

Fintech Growth Insider is back and I think this first issue of 2026 lives up to our new mission of helping you grow faster. I also added a new section after the fintech ad of the week that includes noteworthy fintech stuff from around the web I think you should check out.

Also, I’m happy to announce the imminent launch of the Fintech Growth Insider podcast! By the way, feel free to reply to this email with guest suggestions! I am really looking to uncover the world’s best kept fintech growth secrets with the podcast, so I would be curious to know who you would like to get fintech growth advice from.

Julien

🇹🇷 Revolut Could Enter High-Inflation Turkey By Acquiring Local Digital Bank FUPS

UK-based neobank Revolut is in talks to acquire FUPS, a small Turkish digital bank with a banking licence, as it looks to fast-track its entry into the country.

According to people familiar with the matter cited by Bloomberg, no final decision has been made, and any deal would require approval from Turkey’s banking regulator.

High inflation in Turkey, reaching 34.9% in 2025, have made holding foreign currency common in Turkey. Turks desperately need to hold their assets in USD, EUR, or gold to protect their savings, and it’s something the Revolut platform would be well positioned to offer.

Turkey’s fintech market is projected to grow from $2.2 billion in 2025 to between $7.2 billion and $7.9 billion by 2033 to 2034, implying annual growth of about 15%, according to research by market research firm IMARC Group.

FUPS, currently led by CEO Hüseyin Cem Başcı, was founded in 2022 with a capital of 1.5 billion liras, about $81 million at the time, and employed roughly 60 people as of September, according to Turkish Banks Association data.

Revolut, led by founder and chief executive Nik Storonsky (pictured above), serves around 70 million users globally and was recently valued at $75 billion.

Growth Metric: $7.9 billion fintech market opportunity

Revolut’s acquisition of FUPS could fast track the neobank’s entry into Turkey’s fintech market, which is projected to reach about $7.9 billion by the mid 2030s.

Sources: Fintech Growth Insider & Bloomberg

🇺🇸 Need a Chief Risk Officer but Can’t Justify the Full-Time Hire? Matthew Komos Has the Solution

SPONSORED - When risk oversight starts stretching your bandwidth, OGMA Risk & Analytics steps in. Founded by Matthew Komos, former VP at TransUnion and 25-year risk management and analytic veteran, OGMA delivers fractional CRO expertise to fintechs and financial institutions.

Their Fractional Chief Risk Officer and Risk Department On Demand programs give immediate access to top-tier risk leadership, analytics, and compliance expertise without the full-time cost. Whether you’re scaling, facing regulatory scrutiny, or building your governance framework, OGMA embeds seamlessly with your team to bring structure, clarity, and control.

Because in a fast-moving market, managing risk shouldn’t slow your growth: it should drive it.

🇺🇸 JPMorgan Chase Snaps Up Apple Card Portfolio as Goldman Exits Consumer Lending

JPMorgan Chase is taking over Apple’s credit card program from Goldman Sachs, acquiring approximately 12 million cardholders and $20 billion in outstanding balances.

The deal, expected to be announced soon after more than a year of negotiations, will see Goldman Sachs offloading $20 billion in card balances to JPMorgan Chase for $19 billion, according to The Wall Street Journal.

Apple’s credit card customer base would add to JPMorgan’s 84 million banking customers. The discount is rare in card portfolio sales, where balances typically sell at premiums of up to 8%. This reflects high exposure to subprime borrowers and higher-than-industry charge-off rates.

As part of the transition, JPMorgan Chase plans to launch a new Apple-branded savings account, though, unlike the credit card migration, existing savings account holders will need to actively choose whether to move their funds to JPMorgan Chase or stay with Goldman Sachs.

Goldman Sachs has lost more than $7 billion on a pretax basis since 2020 across its consumer lending businesses. The bank previously sold speciality lender GreenSky and the General Motors credit card program at significant losses.

Growth Metric: 12 million new cardholders

JPMorgan Chase is acquiring approximately 12 million Apple Card users, and $20 billion is outstanding balances.

Sources: Wall Street Journal & The Independent

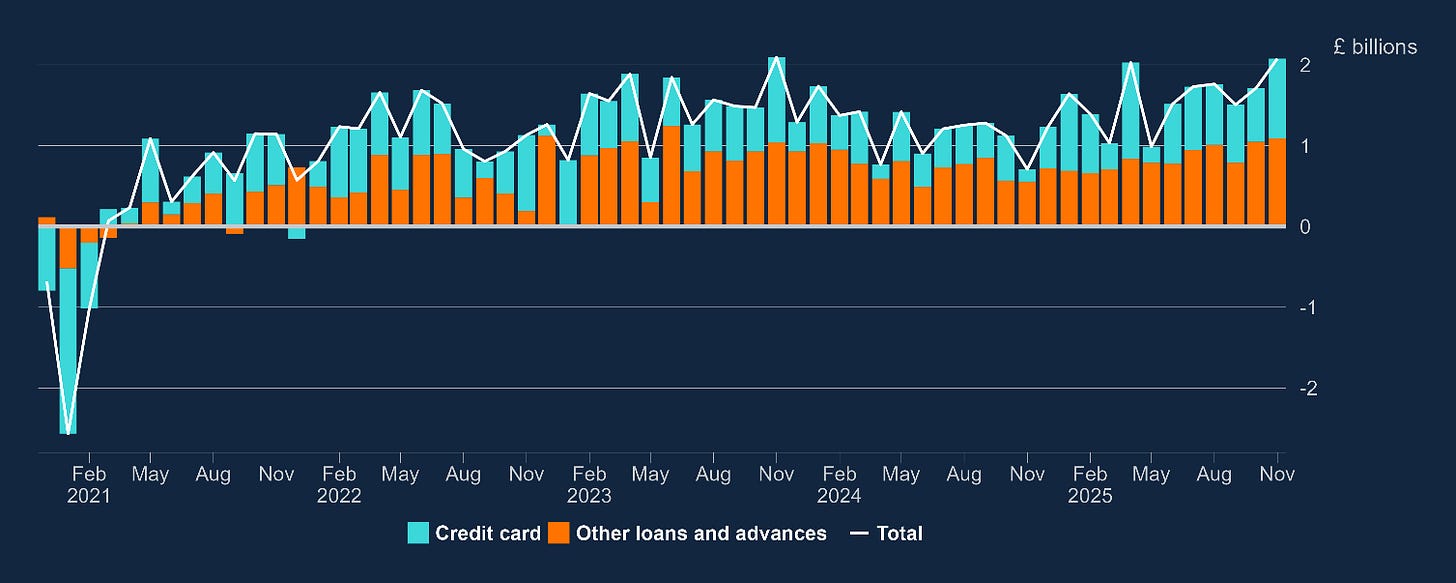

🇬🇧 UK Households Rack Up Credit Card Debt at Fastest Pace in Two Years

UK households racked up credit card debt at the fastest pace in nearly two years, with borrowing surging 12.1% in November, Bank of England data shows.

The surge marks a jump from 10.9% in October and represents the highest figure since January 2024, when credit card borrowing peaked at 12.5%. Britons borrowed a net £1.0 billion (1.35 billion USD) through credit cards in November alone, up from £0.7 billion (941 million USD) the previous month.

Total consumer credit borrowing, including car finance and personal loans, rose to £2.1 billion (2.8 billion USD) from £1.7 billion (2.3 billion USD), with non-card lending accounting for £1.1 billion (1.4 billion USD).

Growth Metric: 12.1% credit card growth rate

UK credit card borrowing hit a 12.1% annual growth rate in November, the highest since January 2024.

Source: Fintech Growth Insider

🇸🇬 Singapore Robo-Advisor Syfe Reaches Profitability on Rising Demand From Asia’s Cash-Rich Households

Singapore-based robo-advisor Syfe has reached group-level profitability in the fourth quarter of 2025.

The company said client returns exceeded $2 billion in 2025, while total assets under management rose above $10 billion. Syfe also paid out nearly $127 million in passive, lower-risk income during the year. The platform is licensed to operate in Singapore, Australia and Hong Kong.

Hong Kong was the clear growth driver as assets under management in said market increased almost sixfold in 2025, making it Syfe’s fastest-growing geography.

Founder and chief executive Dhruv Arora (pictured above) said Syfe is targeting a gap in Asian wealth management, specifically the “mass affluent,” professionals with significant investable assets and higher-than-average incomes, but not yet in the high-net-worth category.

“This demographic has historically been ‘stuck in the middle’: too large for basic retail banking, yet often underserved by traditional private banks,” he explains to Fortune in an interview.

Unlike their Western counterparts, Asian households keep as much as 50% of their net worth in cash, compared with around 15% in the United States and Europe.

Growth Metric: 600% Assets Growth in Hong Kong

Syfe’s Hong Kong assets under management rose almost sixfold in 2025, making it the company’s fastest-growing market.

Sources: Fortune & Fintech News Singapore

🇺🇸 PayPal Expands Ad Platform To Track Actual Purchases, Not Just Clicks

US-based digital payment giant PayPal has expanded its advertising platform with new tools that let advertisers track whether ads actually lead to purchases.

The new feature, Transaction Graph Insights and Measurement, links ad exposure directly to completed transactions across PayPal Checkout and Venmo. Advertisers get dashboards mapping customer journeys and quantifying incremental revenue.

Under chief executive Alex Chriss (pictured above), PayPal is leveraging its 430 million active accounts to give advertisers what Google and Meta cannot, proof of actual purchases.

The feature builds on PayPal’s ad network, first launched in October 2024, as reported by Fintech Growth Insider. It is currently available to US advertisers, with UK and Germany rollouts planned.

The only available test case for the new feature so far is beauty retailer Ulta Beauty, which used PayPal's Transaction Graph to target shoppers and reported a 20% increase in transaction spend and a 136% lift in brand favourability, according to PayPal’s press release.

Growth Metric: 20% sales lift

Early adopter Ulta Beauty saw a 20% increase in transaction spend during campaigns using PayPal’s verified purchase data

Source: PYMENTS

🇧🇷 Brazil's PicPay Pursues $500 Million IPO, First Major Latin American Listing Since Nubank

Brazilian digital wallet and credit lender PicPay is heading to the US stock market, aiming to raise $500 million through an IPO.

This move follows a strong financial performance in 2025, where the company saw its profits jump by 79% in just the first nine months. The Amsterdam-incorporated firm posted profits of 270.4 million real ($50.3 million) on revenue of 7.26 billion real ($1.35 billion) in the nine months ending Sept. 30.

The company has aggressively expanded into lending, far more profitable than basic payments, and now offers credit cards and personal loans to its 42 million active users, with a focus on secured loans like payroll-backed loans. The neobank is headed by Eduardo Chedid.

PicPay sets itself apart from Nubank by debuting in the black. While Nubank went public with a $165 million loss, despite having more users (48 million) and higher revenue ($1.7 billion), PicPay is already profitable, reporting $50 million in net income on $1.3 billion in revenue from its 42 million users, according to its IPO filings.

Growth Metric: 79% profit growth

PicPay achieved 79% profit growth year-over-year by pivoting from digital wallet to high-margin lending.

Sources: Fintech Growth Insider & Bloomberg

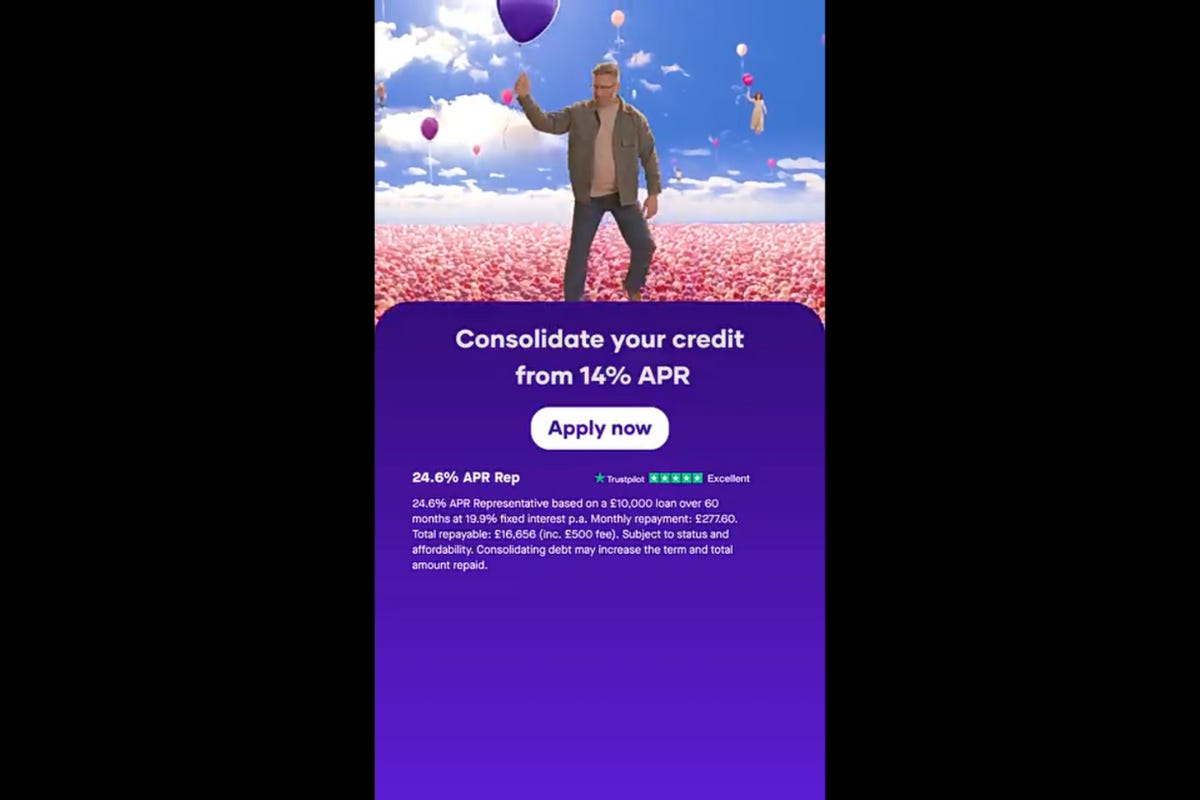

🇬🇧 Fintech Ad of The Week: Updraft Visualizes “Falling” Into Debt With One Too Many Taps

UK lending app Updraft has launched a new ad campaign following the holiday season, reminding consumers that tapping away on credit cards can sink them deeper into debt.

The ad positions Updraft as a lifeline to help borrowers refinance credit card debt with a lower-interest debt consolidation loan. Updraft, launched in 2020, advertises rates as low as 14% APR, though that rate only applies to excellent credit profiles.

Source: Fintech Growth Insider

Noteworthy Fintech Stuff From Around The Web

In the December issue of Fintech Takes that I finally read this morning, Alex Johnson writes an excellent piece about the Cash App’s own credit scoring model, which gives them a huge customer acquisition edge. Their proprietary model allows them to increase their approval rate by 38% compared to when they are using VantageScore’s model, and the charge-off rate is comparable!

Donald Trump’s intention to cap credit card interest rates at 10% in the US could mean that credit card issuers could no longer serve in a profitable way Americans with a credit score below 740, resulting in 82% to 88% of all credit cards accounts in the US facing closure.

Rakuten Advertising, one of the top 3 affiliate networks, has banned PayPal-owned Honey browser extension from its network due to repeated policy violations.

Upcoming Fintech Events

🇨🇳 Consensus Hong Kong will take place from February 18 to 20, 2026, at Hong Kong Convention and Exhibition Centre, with tickets priced between $399 and $799, with speakers such as Jordan Gray (CoFounder and CMO, PublicAI), Joelly Gloria (Business AI @ Meta), and Ming Wu (Co-founder/CTO, 0G)

🇬🇧 TradingTech Summit London will take place on February 26, 2026, at Hilton Canary Wharf, with tickets priced at £895, with speakers such as Nafisa Yusuf (Director and Head of International Market Structure, BlackRock), Stuart McDowell (UK Chief Information Officer, Societe Generale), and Monika Fernando (Head of Global FI Client Data Analytics and Head of FI eTrading Strategy EAP).

🚨 GFI Exclusive Offer: Enjoy a 15% discount on tickets using the GFI15 promo code

🇺🇸 ICBA LIVE will take place from March 6 to 9, 2026, in San Diego, with speakers such as Rebeca Romero Rainey (President and CEO, Independent Community Bankers of America), Jack E. Hopkins (ICBA Chairman and President and CEO, CorTrust Bank), and Alice P. Frazier (ICBA Chairman elect and President and CEO, Potomac Bank).

🇺🇸 T3 Technology Conference will take place from March 9 to 12, 2026, in New Orleans, with speakers such as John O’Connell (Founder and CEO, The Oasis Group), Raj Madan (Chief Information Officer, AdvisorEngine), and Oleg Tishkevich (Chief Executive Officer, Invent).

🚨 GFI Exclusive Offer: Save $200 on tickets using the T3GFI200 promo code!

🇬🇧 CBC Summit Europe will take place on March 17, 2026, in London, with tickets priced between £906.43 and £1,246.53, with speakers such as Jason Allegrante (Chief Legal and Compliance Officer, Fireblocks), Ajay Amlani (President and CEO, Aware, Inc.), and Sabih Behzad (Head of Digital Assets and Currencies Transformation, Deutsche Bank).

🇬🇧 Insurtech Insights Europe will take place on March 18 to 19, 2026, in London, with tickets priced between £399 and £999. Speakers include Sirma Boshnakova (Board Member), Cécile Paillard (Group Chief Transformation Officer), and Pravina Ladva (Group Chief Digital and Technology Officer).

🚨 GFI Exclusive Offer: Enjoy a 25% discount on tickets using the GFI25 promo code!

🇺🇸 Fintech Americas will take place from March 24 to 26, 2026, in Miami, with tickets priced between $795 and $2,195, with speakers such as Cristina Junqueira (Co Founder and Chief Growth Officer, Nubank), Biswa Sengupta (Managing Director for Generative AI, JPMorgan Chase), and Rohit Patel (Director, Meta Superintelligence Labs, Meta).

🚨 GFI Exclusive Offer: Enjoy a 10 percent discount on tickets using the GFI10 promo code.

🇬🇧 PAY360 will take place from March 25 to 26, 2026, in London, with speakers such as Will Marwick (Chief Executive Officer, IFX Payments), Jas Narang (Chief Transformation and AI Officer, Santander), and Saira Khan (Head of Innovation and Partnerships, First Direct Bank).

🇺🇸 InsurTech NY Spring will take place from March 30 to 31, 2026, in New York City, with tickets priced between $657 and $1,017, with speakers such as Raj Kalahasthi (Chief Information Officer, The Baldwin Group), Patrick Gallic (Head of International AI Hub, Tokio Marine), and Greg Hendrick (Chief Executive Officer, Vantage Risk).

Who Am I?

Hi, my name is Julien Brault.

From 2017 to 2024, I was the CEO of Hardbacon, a fintech I co-founded, which reached 400,000 unique visitors at its peak.

A Google update ultimately sealed the company’s fate, and I started this newsletter to keep myself busy in the aftermath.

I then launched an another fintech affiliate site called MooseMoney, but I still find the time to publish this newsletter.

Why share this?

Because my goal is to use my experience as an economic journalist, fintech entrepreneur and product manager to present the most essential fintech news from around the world through the eyes of an insider.

If you like what I do, feel free to share this newsletter and follow me on LinkedIn, X, Reddit, YouTube & TikTok.

If you would like me to accompany you on your fintech entrepreneurship journey and provide you with ongoing feedback, feel free to hire me as coach on MentorCruise.

If all you need is to pick my brain on specific topic in the field of fintech marketing, product or strategy, feel free to book a one hour consulting call with me instead.

P.S : Once you refer a new subscriber to the newsletter using your unique share link, you'll receive a personalized social media shout-out from me to promote your work or professional profile. Just write to me at jrbrault@icloud.com once your referral is confirmed on our leaderboard and include your social media account(s) URL(s) and who you are.

Revolut’s potential FUPS acquisition highlights how neobanks are strategically entering high-growth, high-inflation markets to meet rising demand for foreign currency services