Born in Belgium, Wealthsimple’s Chief Growth Officer Simon Lejeune wanted to be a journalist growing up. His parents did not think it was a great idea, and Simon decided to study business engineering to keep his parents happy, with the secret goal of, one day, owning a newspaper. He moved to Montreal after graduation, and held various marketing jobs that led him to become head of user acquisition at Hopper, a flight booking app now valued at $5B.

In February 2020, a few weeks before Covid paralyzed the airline industry, Simon generously agreed to meet with me at the Hopper HQ in Montreal to give me some growth tips for my own fintech venture. The Chinese economy was starting to grind to a halt, and I asked Simon if selling plane tickets was harder as a result. I was surprised when he said conversion had never been as high, as airlines were discounting their tickets.

This bonanza did not last, though, and Hopper ended up making deep cuts to weather the storm. Simon left Hopper to start a growth marketing agency and Wealthsimple quickly became one of its top clients.

Founded in Toronto in 2014, Wealthsimple was initially a robo-advisor offering low-cost ETF portfolios. In 2019, it ran with Robinhood’s playbook and launched the first zero-commission trading app in Canada.

It was an instant hit, but it became more than that after Covid hit. People were bored and flush with generous government aid cheques. As a result, an entire generation got into stock trading using the Wealthsimple Trade app. When Simon was offered a full-time job at Wealthsimple in 2021, he did not think twice.

Simon Lejeune: I worked for like eight to 10 different clients. Wealthsimple was one of them, and I was super close. I was seeing the rocket ship was about to launch and I was on the launch pad. Don’t stay on the launch pad when someone offers you a seat on the rocket. I really liked Mike [Katchen], Brett [Huneycutt], and Rudy [Adler] in marketing. I thought they were super smart and knew what they were doing. So I decided to fully join Wealthsimple with a couple of people who were working with me at the agency at the time. We’re still working with Wealthsimple now.

Julien Brault: Did you move to Toronto?

SL: No, I stayed in Montreal. That was also interesting because it was during COVID. Wealthsimple really grew during COVID and went from a couple hundred employees to over a thousand. We’re a super distributed team. My leadership team in growth marketing, I have someone in New York, someone in Vancouver, someone in San Francisco. It’s very remote first. We do have a core office in Toronto where people go.

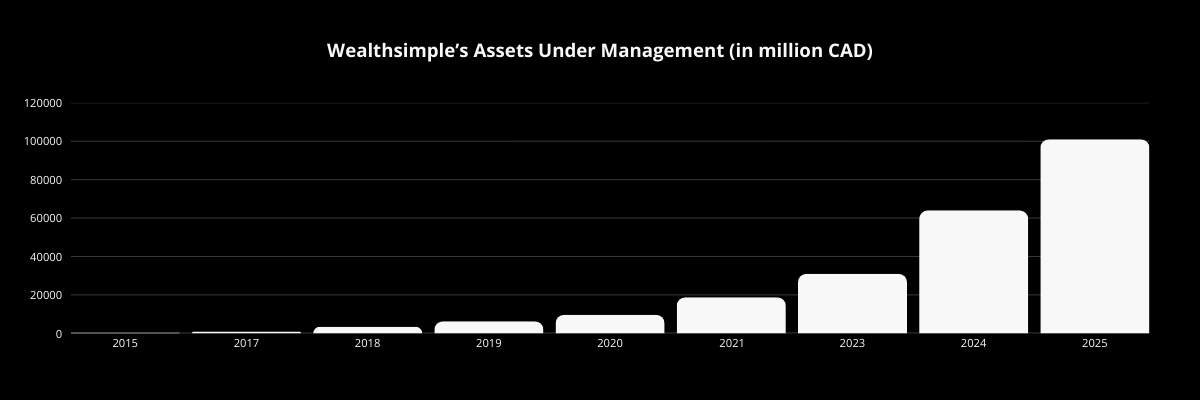

JB: You joined Wealthsimple in 2021, and at the time Wealthsimple was known as the robo advisor. I think they had started Wealthsimple Trade, so they were a little bit like the Robinhood of Canada. It was around $10 billion in 2021 when you joined, and now we’re talking about $100 billion. There was a 10X growth. How is marketing different to go from 0 to 10 or 10 to 100 in a fintech? Obviously you cannot just do the same thing to get so much more assets.

SL: Totally. It was a super important pivotal year for Wealthsimple, a pivotal moment for sure. I think the success was already sort of baked in at its inception because it’s the same people, the same mission, the same culture, and the same naive ambition of trying to become the largest financial institution in Canada. What is also still the same is a very high quality, high bar for product. We’re a very product led organization. We still grow mostly by expanding our product suite or improving existing products. What hasn’t changed is our brand strategy. It’s the same people making still unbelievable, unique, different ads.

JB: I had a question I wanted to ask you later about that. I see a lot of fintechs that reach a certain scale and all their marketing budget was performance, Facebook ads, TikTok ads. Then they realize huge companies like Airbnb are investing so much in branding, and they start to say, “Okay, we should probably put a percentage at least of our budget into branding.” In the Wealthsimple case, I’ve followed them since pretty much the beginning. They always had care for branding. I’ve seen billboards since way before it was worth $10 billion. What’s the role of branding at Wealthsimple and why do you think they invested in branding since the beginning?

SL: Yeah, I think there’s multiple ways to tell this story. When I think about it, it’s because that’s what the people at the time in the marketing team knew how to do. Rudy [Adler] was one of the three co-founders, and he worked in ad agencies in New York. He was this very creative guy, and he hired a bunch of people from very creative backgrounds. They didn’t really necessarily have the performance marketing DNA. In a way, that’s how we’ve operated. Hire really smart people and then let them do what they’re really good at. They’re really good at brand marketing. In retrospect, it was kind of interesting because it is an industry where you need a lot of trust and credibility for convincing people to move their life savings to you. All that brand investment they did in the first few years paid a ton of dividends.

All that brand investment they did in the first few years paid a ton of dividends.

When we went from $10 billion to $100 billion, we started to really accelerate with growth marketing. We had a lot of that trust and credibility and brand love in the bank, so to speak, to make those performance dollars go even further. The way I think about brand and performance marketing is that they have different time horizons. If you’re an early fintech startup, I usually would still advise you to invest first in performance marketing. I think Wealthsimple is maybe a bit unique in that sense, unless you have a crazy filmmaker on the team who can make amazing films, then let them do that. But you do performance marketing because you don’t know if you’re going to be alive in five years. Why would you invest in a brand that might not be around in two, three years? Eventually, as you gain confidence in your trajectory, you want to start investing in brand slowly and more and more. I see it as like a portfolio of investment where you need to have dollars going into next week, next month, next quarter’s results, but also start investing more in brand for the next two, three, five, 10 years. It compounds everything else.

JB: Do you know what the percentage of investments in branding versus measurable ROI driven performance marketing is today?

SL: We do more growth marketing, more performance marketing. I don’t know the exact percentage, but the way I think a brand marketing investment is sized, you set a budget based on how big your company is, how much you can spend without obviously bankrupting the company. Maybe you’re going to put 10, 20, 30% into brand. Whereas performance marketing budget, you don’t necessarily have a set budget to spend, but you have a target you want to hit in terms of return on investment or payback periods or IRR. If you find a pocket of profitable investment, you start to really press your advantage. It’s not even a cost center, it’s more revenue generating investment. We have found a few pockets like that, and we’ve been able to scale our investment into growth marketing to a point where it started to take over any other investment at the company at some point.

JB: How do you decide if you should invest in a campaign about the cash account or the trading account or the tax account? How do you make those types of decisions?

SL: In terms of growth marketing, we try to be a little bit more agnostic and say, how are we going to deploy our budget to get as many clients through the door in a profitable way? Eventually, what we’ve seen is once clients get through the door, they slowly but surely adopt most of our products.

JB: So if I understand well, the goal is to get as many new clients as opposed to being like, “This line of business is a little more profitable.” It’s not really a profitability calculus, but more how much it costs to get someone in the door. Maybe it’s not the most profitable product, but then the lifetime value is high, so you can cross sell.

SL: Yeah, it is a business, right? So we are trying to drive revenue growth to allow us to grow as a business. We do look at each product line and profitability. But like you said, the keyword we’re looking is lifetime value. There’s no point in you joining, getting burned into a very profitable product for us that was a bad fit for you, and then you’re going to leave after six months.

JB: As a marketer who manages millions of dollars per month in ad spend, what keeps you up at night?

SL: The fraud on Meta is out of control. I don’t know if you saw the recent report that about 10% of their revenue was potentially coming from fraudulent ads. If you go into the Facebook ads library today and you type the keyword “Wealthsimple,” there’ll be more fraudulent ads, but that works with any fintech brand, by the way. You can try Questrade, any, even the banks. There will be like 10 times more fraudulent ads than legitimate Wealthsimple ads. They use the name Wealthsimple in the copy and images. They use fake AI avatars of [Wealthsimple CEO] Mike Katchen or whatever. We report them every single day. We try to warn our customers about this, but it takes several days to take them down.

JB: Their AI is not able to do a simple keyword search?

SL: Clearly, their AI is able to do it, right? So it’s not about whether they have the technical capability. Google clearly allowed this a long time ago, where you can’t use my brand in your ad copy if I register my brand. Facebook just needs to do the same. I almost want to tell our customers “Never click on an ad online about Wealthsimple,” but I don’t want to say that because I still want to use those channels.

JB: I don’t see ads for financial scams on TV. Does it inform your decision as a strategist? On one hand, you want the performance, but on the other end, you might actually hurt your brand.

SL: Totally. We’re definitely thinking about that. If Meta is not moving fast enough, we will have to make decisions.

JB: I was listening to a podcast where you were interviewed and you were talking about an idea. I think you never did it, but the idea was to organize a Taylor Swift concert and use Taylor Swift tickets as a sign up incentive, a little bit the same way that you’re offering iPhones or other kinds of sign up incentives. Did you actually contact Taylor Swift? I wanted to know why it didn’t happen and are you working on another show or something like that?

SL: I haven’t heard back from Taylor Swift yet. So if she listens to your podcast, I would love for her to text me back. I do have a long list of ideas. There’s nothing I love more than spending my marketing budget and putting those dollars back into our clients’ pockets. It’s just amazing. I love my partners at these digital platforms, but if I can give my money to my clients instead of giving my money to Facebook or Google to convince my client to use my product, I’ll do that every day. The math works really well for us right now. We are contemplating a lot of ideas. I always talk to my clients like, “What’s the most exciting thing we can give you back?” Cash is fun and a lot of people love cash, but you also want to grab the attention and shift people’s perception.

JB: How do you figure out what’s the right sign up incentive? For the iPhone, I guess you have all the data in the world. You know what device your clients are using. But for Taylor Swift or other incentives you’ve given away, do you do surveys? How do you figure it out?

SL: We do surveys, we read our clients’ feedback. We are our own clients, so a lot of the times it’s like, “What would we be excited about?” Then it’s a lot of testing. We try to validate a lot of ideas with small groups of clients before we roll it out to large groups of clients. Two out of three ideas are just not working and we’re not rolling them out. That’s kind of how we do the market analysis. We look at what seems to work elsewhere. We’re all fintech nerds, we’re all bank nerds. We love to dig into offers that exist in other geos. We love to look at offers that existed in the past. I don’t know if you know, but banks used to give toasters in the fifties and the sixties to new customers. Nothing is ever created, right? It’s just the same idea over and over.

JB: It was the old iPad.

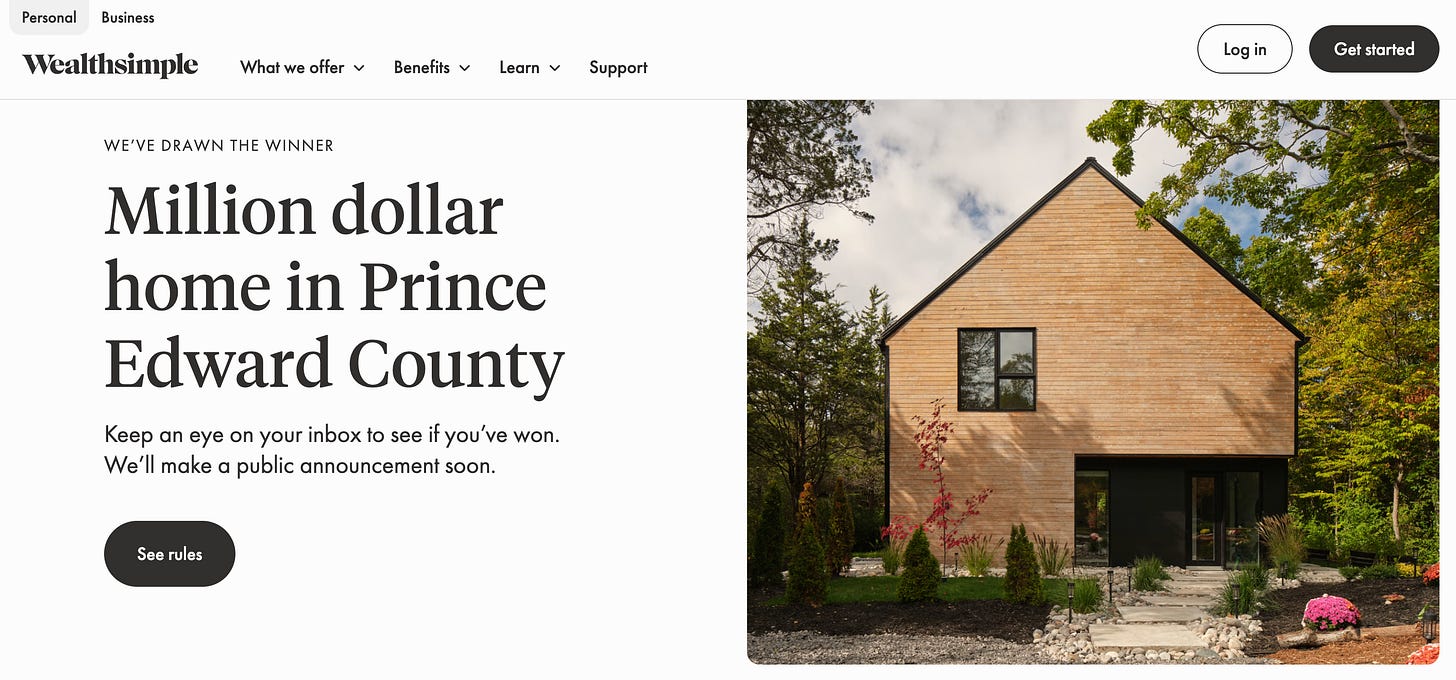

SL: You could literally bring a friend with you to the bank. The referral program in the past, and you would get some kind of catalog with appliances because that worked and that still works. I don’t know if you saw recently, we gave away the biggest thing you can think of. We gave away a house, a million dollar house.

JB: I missed that. Tell me more about it.

SL: We’re fascinated by giveaways and how they work in general. How do we find the most exciting one? A lot of our clients are saving for a home. We are the number one institution in terms of number of FHSAs market share. We also recently launched a mortgage product with Pine, another fintech in Canada. So, how do we combine all of these things? Mike, actually the CEO, is my number one idea guy at the company. He sends me new ideas all the time. He was like, “Hey, we should try this.” He had heard it on a podcast from another company. We went from idea to buying the house, furnishing it, staging it, organizing it, doing the microsite, the rules and regulations, and everything that goes into this in like six weeks.

JB: So how did someone get the house? How do I get the house? I don’t have a house.

SL: You could participate in October. Every dollar you deposited was an entry into the draw. Now it’s closed, but we still have clients who initiated transfers. That’s another big friction point in fintech. Those can take sometimes up to 60 days to complete. Most are like five days. We are waiting for everything to complete so we can combine entries and do the draw. The deadline has passed.

JB: Where’s the house?

SL: Keep your eyes open because it was the most successful campaign. The house was in Prince Edward County, a bit north of Toronto. We have a lot more ideas. If it’s not Taylor Swift, I’m sure we can make it almost as exciting as that.

JB: I mean, Drake is an investor. Is that telling us something?

SL: Yeah, maybe, maybe.

JB: On another podcast, you said that about 90% of your marketing budget is going in the pockets of your clients. I was like, how is it even possible? Because you need people to know they could win a house, or an iPad, or a concert ticket. Tell me more about how it works.

SL: I’ll give you a two part answer. First, it’s part of the shift that happened right after COVID. We acquired very quickly almost 2 million clients, but they only had a couple thousand dollars with us to buy a few stocks on crypto. A lot of our strategies since then, and that’s kind of how we went from $10 billion to $100 billion, was getting those clients to consolidate, to transfer assets to us. We built so much into our transfer products. I joke sometimes with my product colleagues that we are a transfer app with some banking and investing services attached to it because we innovated so much into how people can transfer their accounts from elsewhere into Wealthsimple.

We don’t need a ton of advertising to reach those customers because they are our customers. I think we have a great email notification and in app messages strategy that people pay attention to because we try to keep it interesting. People love our brand, they love the tone, and they love our offer, so they keep paying more and more attention to it. Once we launch an offer like that, we can get 500,000 people, a million people from our client base to already pay attention and participate. That’s the first part. The second part is we do a little bit of ads just to kick things off and get the word out. But most of the outside growth comes from word of mouth. A lot of our thinking goes into crafting offers that can go a little bit viral with your friends, with your Instagram DMs, with some forums on Reddit, on RedFlagDeals, et cetera. You get the word of mouth distribution instead of having to pay for it. If you’re giving away a house, a one million dollar house, you don’t need to do Facebook ads. It’s a good story, right? You might tell your friends. We also work a little bit with influencers to spread the word, but influencers are like paid word of mouth in a way.

JB: I feel like we’re touching the key of how you get from $10 billion to $100 billion. Just convincing the guy who put $1,000 to put $100,000, right? That’s really interesting. Is it different? Because it’s a different type of marketing. Do you have a team that is just like, “How do I get more asset management from existing clients” versus people that are trying to get people through the door? How does it work structurally?

SL: Yeah, precisely. My team is basically client growth and deposit growth, assets growth. I changed that maybe a year ago where it was like the acquisition team, the email team. No, let’s structure teams with goals and let them figure out the tools they want to use or become experts at. We have the client growth and deposit growth teams, and they have very different strategies. Most of our promotions and offers are run from the deposit growth team. If an offer has a goal of acquiring new customers, like the referral program or the affiliate program or SEO, SEM, that will be run out of the client growth team.

JB: Now that we’re talking about structure, in marketing there’s a bunch of titles around, and each company works differently. You’re Chief Growth Officer. I assume Wealthsimple also has a Chief Marketing Officer. Are they the same department, different departments? Do you have engineers working for you, or do you need to convince the CTO to lend you some engineers? How is it structured at Wealthsimple?

SL: If you work in tech in any company and it’s not the engineering department, half your time is trying to convince and lobby the CTO and the engineering team to work on your priorities, right? Growth marketing simply sits within the marketing team. The marketing team is like three big departments. It would be the creative group where you have brand marketing, creative production, art direction, et cetera. You have product marketing. They work very closely with the product team. Every time we launch a new product, they work to position it and have the page ready and have a bit of a go to market strategy. They also run our events at Wealthsimple Presents. Then you have the growth marketing team who will run the incentives, the ads, the referral program. It is part of the creative ecosystem.

JB: Is branding part of your team or part of the creative team? Do you have your own engineers or do you need to fight for them?

SL: Yes, we have a handful, I don’t know, like four to 10 engineers at all times who will help us work on these in product offers or new features where the first priority or the reason we’re launching the feature is to, for example, allow clients to more easily share the app to their friends, make the onboarding a little bit easier, make the transfer process a little bit easier. Growth oriented features.

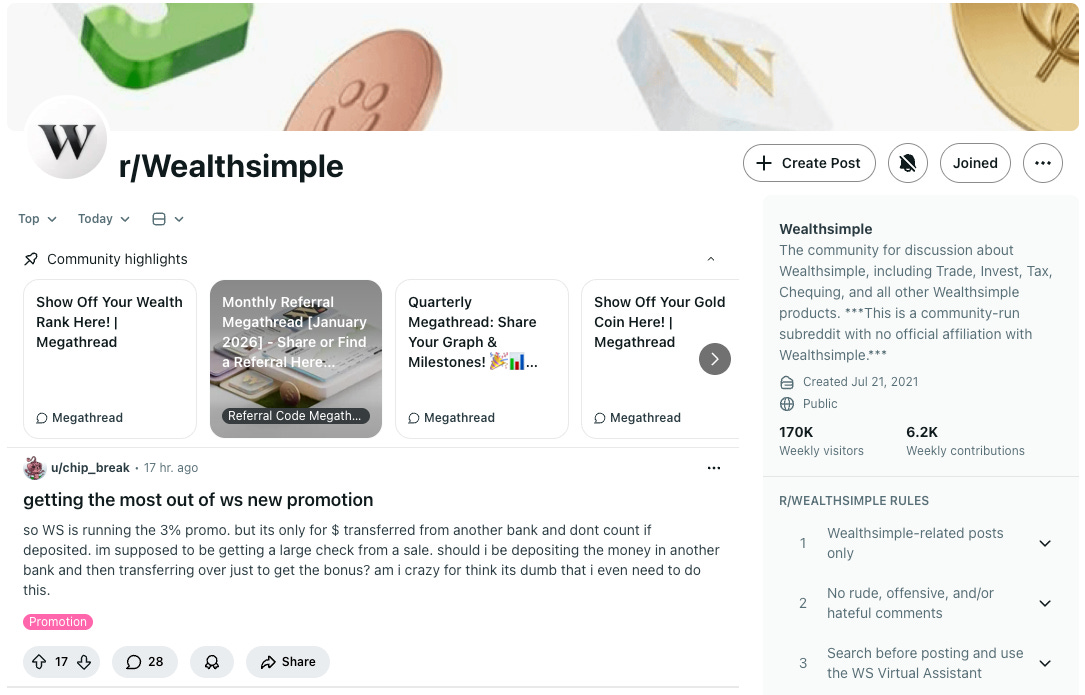

JB: Wealthsimple has one of the largest dedicated communities [for a fintech], 121,000 members, last time I checked, on Reddit. I know some companies in fintech like Ramp hired a head of Reddit. Do you have a dedicated person? Also, is your community owned by Wealthsimple or is it owned by random fans of Wealthsimple? I’d like to hear about your Reddit strategy.

SL: It’s completely owned and operated by clients. We’re not really actively policing it or giving any sort of influence. We’re super lucky. We have awesome clients and fans. They participate in moderating the sub, and it’s a big part of the feedback loop. They’re super active. Every time we launch a new product, the joke internally is, “How quickly is it going to show up on Reddit?” Usually it’s a few minutes before someone posts something we just shipped, and it’s great to hear the feedback and read it.

JB: So you don’t even need to pay for community managers. What do you think about that?

SL: No, no, we don’t. We have started to engage with a few Ask Me Anythings, and the response has been great. I love our Reddit community, even when it’s hard to read. It’s important. Some weeks they say I should get a raise. “The guy who came up with this should get a raise.” But the next week it’s like, “This guy who came up with this should get fired.”

JB: In 2024, Wealthsimple became profitable for the first time since it was founded in 2014. Did Wealthsimple becoming profitable had an impact on your ability to do crazy growth campaigns?

SL: It hasn’t really changed that much other than it was a great moment and signal, because I think especially for Mike, he has been hearing from the start, “This business can’t go anywhere. You can’t make it work with such low fees. You’ll never be able to get market share from the big competitors.” As long as you’re not profitable, these critics can still say, “Sure, you can probably subsidize this growth and whatever in this product, but there’s nothing there.” I think the profitability is just a great validation for the team, for the business, for the customers as well. We’re here to stay. We don’t need anyone’s help or support if we don’t want to. We are a sustainable business. On the growth and operation side, it’s still full gas. That has not changed. If anything, now it’s more like we can be a little more comfortable and decide, okay, what level of profitability do we want to reach and how much do we want to invest? We’re just getting started. $100 billion is great. I think we’ll start to be happy if we reach a trillion in assets and start becoming one of the largest institutions.

JB: You guys keep repeating you want to be the largest financial institution in Canada. So how do you get there? You don’t have a banking license. Is it part of the plan? And how do you get from $100 billion to a trillion?

SL: We want to be the largest institution in Canada. That’s the first step at least. There’s two ways we look at this. First, in terms of clients, the major banks in Canada all have about 10 million plus clients. That’s one way we want to compete. We’re at 3 million plus and growing really fast. That gives you a measure. The other one is assets under administration. That includes assets under management and then self directed assets. Some of the banks are at $1 to $1.5 trillion. Some of the smaller ones are at $300 to $400 billion. We have 3 million clients. The way I think we get to 10 is by advertising more, by building more features around trust. But also we want to show up more in the real world so people understand we’re not just an online website to go buy a bunch of crypto. We’re a much more serious institution. On the banking side, this is our fastest ever growing product. It’s basically now just getting to parity with your traditional bank account, but we’re already seeing tens of thousands of people who use Wealthsimple Chequing account for their day to day banking needs, and that’s just getting started. I think we’re going to see a massive acceleration there in the coming years. Both the investing and the banking side of the business will compound to get there. We can for sure triple. It’s a matter of time. For me, it’s more like, how quickly can we triple versus can we actually triple? Also, don’t forget, time is on our side. We have the generation. For example, FHSA, a new account type that started. We had, I think at some point, more than 40% of market share in FHSA.

JB: Wealthsimple has 3 million clients and you mentioned Canada’s largest banks have 10 million. Given your previous growth trajectory, it seems likely you can triple your customer base. But if you want to become Canada’s largest financial institution, you need to do something much harder. You need to convince your clients to make Wealthsimple their primary bank like Nubank did in Brazil. How do you do that, given the fact that Canadians are known for being very loyal to their bank?

SL: I use that as a proxy. I don’t know the exact numbers. I don’t have the market data, but if we can get about half of Canadians who start investing to start investing with us, it’s kind of a matter of time until we can get half of the market. But we don’t want to wait for that. The other thing is you have the great wealth transfer from the boomers and the generation after that who are going to eventually share their wealth with their kids, their millennial kids who are in Wealthsimple. We also have that going for us. But then I think what’s interesting to me is, is the strategy to go from zero to 3 million going to be the same to go from 3 to 10 or 15 or 20? Or do we need a different strategy because this audience is a little different, is a little more reticent to use an online product? That’s something I’m very focused on trying to figure out. And then, how to make you use it for your daily banking. At its most simple, we need to make the product 10 times better, 10 times cheaper. If I try to think about it very simply, only then can you get a chance at someone to switch their primary banking. Nobody wants to change their primary bank. It’s so annoying to move away, to transfer your e-transfer contacts, your payees, etc. There is a ton of work that goes into this so you could switch in a click.

The same way we are almost there on the investing side, the same thing could happen with banking. But if the product is 10 times better, 10 times cheaper, and not only can we catch up with the features parity that we need to with the banks, but we can start innovating and creating unique features on the chequing account. I’m happy to share that with you, but we are seeing more new chequing account clients on a daily basis than new investing clients, despite chequing being a much younger product. The line is just going straight up and to the right. This is really exciting.

We are seeing more new chequing account clients on a daily basis than new investing clients, despite chequing being a much younger product.

JB: You said in the past that the head growth of a startup is always the CEO. So my question is how closely do you work with Mike Katchen, the CEO of Wealthsimple?

Mike is awesome. He sends me growth ideas almost every day. One simple question that he asks often is, when you pitch an idea to him, “What’s the way more ambitious version? What is the 10X version of this idea?” It’s a great thought exercise to make your idea maybe not 10X bigger, but 20, 30, 50% bigger than you initially imagined.

JB: About six months ago, Wealthsimple announced the launch of a Visa card with 2% cashback. Within weeks, you had 200,000 people on the waiting list. Demand exceeding supply is generally a good thing in growth, but then people started to complain it was taking too long. As of now, how many people got the card so far?

SL: I can’t share specific numbers, but we do have a lot of demand for the card and it’s growing because I think the card is now in the wild in the hands of tens of thousands of people. They see how amazing it is and share it with their friends, which is creating a bit of a bigger headache for us, to be frank, because we have so much demand that we need to manage.

They see how amazing it is and share it with their friends, which is creating a bit of a bigger headache for us, to be frank, because we have so much demand that we need to manage.

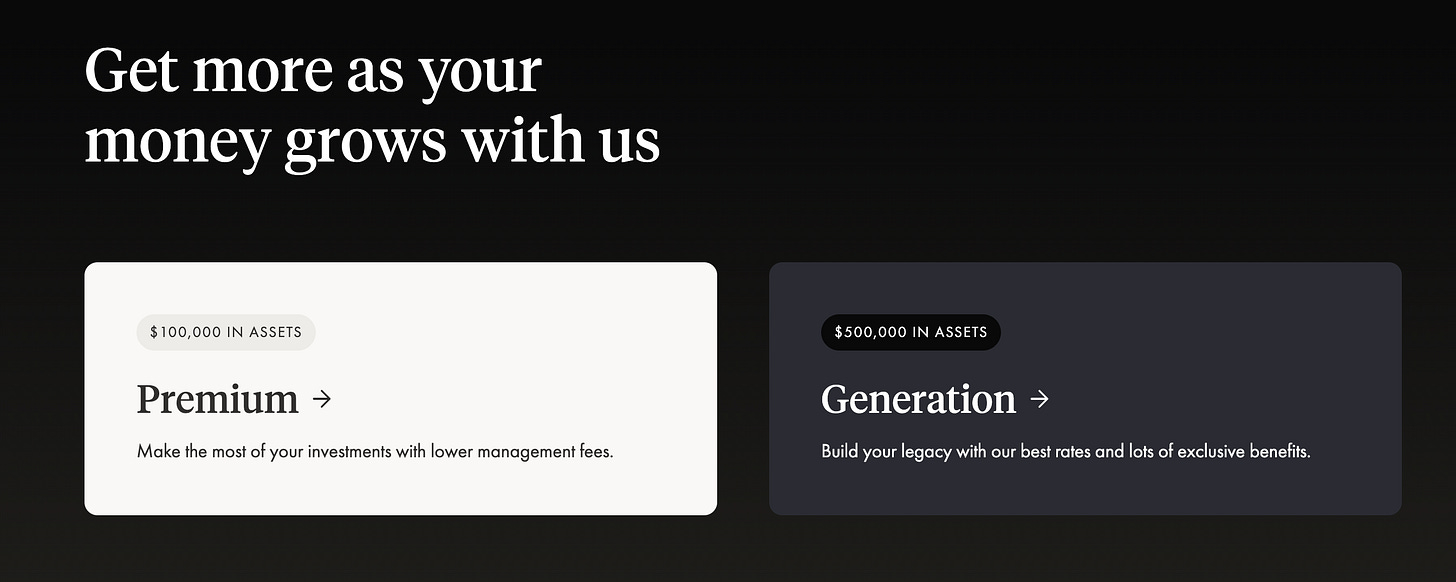

We are rolling out. If you are a Generation client by the end of the year, you’re going to have the option to apply for the card for sure. Or if you’re a Premium client, that’s $100,000 plus with us and you have your paycheck with us. Generation Client is $500,000 plus. So people with a lot of assets probably already have the card. Well, at least if you are with us with a lot of your assets, you will have access to the card. The third category of people we are prioritizing is people who have been with us for the longest, our most loyal clients. But yeah, it is a challenge. It’s not a simple product. It’s probably the most complex product we have launched so far.

JB: Why did you go with the waitlist approach? I know you used it for Wealthsimple Trade. Robinhood was launched with a waitlist. Is it to create scarcity? Because you could have done a private beta and waited and tried to keep it somehow secret and then said, “It’s open and now you’re able to send 50,000 cards a week.” But it would have taken probably much longer.

SL: We did a lot of testing, right? It was first with employees and then with small groups of people, and then eventually we opened it up. It was not to create scarcity. It’s just that there are constraints when you launch a credit card program. You want to build a bit of a track record when you launch a new credit product. We’re a bit new in the borrowing space. We launched margin, we launched a portfolio line of credit. We’re launching a credit card. It is a different business and we want to get it right. We don’t want to mess it up. We want to make sure we care about the trust that our clients put in us, but also our financing and funding partners put in us, because ultimately we are allowing you to use a card and paying us a month later. We want to make sure everything happens properly.

JB: Do you have a mechanism where I can invite my friends to the list and get up higher? What are the marketing benefits of the waitlist?

SL: Right now, we’re just really focused on giving it to Premium Plus clients who moved their paycheck to us, Generation Plus clients, and our most loyal clients.

We have a small amount of cards that we are reserving for growth experiments. What you’ve heard from me is we’re doing a lot of these small growth experiments. They’re not too big, to be honest with you, and they’re not really scalable because we have that waitlist. But we want to make sure we experiment with enough things so that the moment we can open up to more clients, we’ll be ready.

JB: That was Simon Lejeune, Chief Growth Officer at Wealthsimple. Thanks for listening to my show. Make sure to follow Fintech Growth Insider on your podcast app so you never miss a new episode. And if you are interested in stealing proven growth tactics from your fintech competitors, please sign up to my newsletter on fintechgrowthinsider.com.